Q1 FY16 Results Update and Frequently Asked Questions

Q1. What is ITC's Vision and Mission?

Answer:

Vision:

Sustain ITC's position as one of India's most valuable and admired corporations through world-class performance, creating growing value for the Indian economy and the Company's stakeholders.

Mission:

To enhance the wealth generating capability of the enterprise in a globalising environment, delivering superior and sustainable stakeholder value.

Q2. How does the Company effectively manage a highly diversified business portfolio? What is the Company's Corporate Governance structure?

Answer: ITC's 'Strategy of Organisation' is crafted in a manner that enables focus on each business while harnessing the diversity of the portfolio to create unique sources of competitive advantage. Please refer to the following link http://www.itcportal.com/about-itc/values/corporate-governance-structure.aspx for details of ITC's 3-tier Governance Structure.

Q3. What is the Company's shareholder value creation track record?

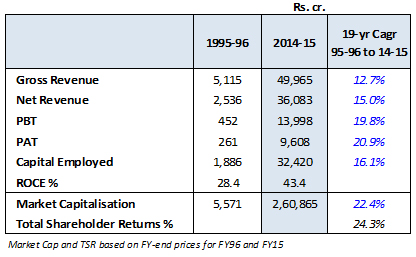

Answer: ITC has been a consistent performer in terms of shareholder value creation. During the period 1995/96 to 2014/15, Total Shareholder Returns have clocked compound annual growth rate of 24.3% significantly outperforming the Sensex (11.8%).

Q4. Please provide a brief overview of Q1 FY16 results.

Answer: The Company's performance during the quarter was subdued reflecting the unprecedented pressure on legal cigarette industry volumes, sluggish demand conditions prevailing in the FMCG industry and lack of trading opportunities in wheat and soya. Net Revenue for the quarter stood at Rs. 8505.53 crores. Profit Before Tax at Rs. 3432.23 crores and Net Profit at Rs. 2265.44 crores registered a growth of 5.1% and 3.6% respectively during the quarter. Earnings Per Share for the quarter stood at Rs. 2.83.

Q5. (a) Why has 'Consumption of Raw Material etc. (net)' decreased by Rs. 809 crores during Q1 FY16 as compared to Q1 FY 15?

Answer: Decrease in Consumption of Raw Materials (net of changes in closing inventories of finished goods, work-in-progress & stock-in-trade and purchase of stock in trade) primarily due to decline in the share of traded agri commodities in the portfolio.

Q5. (b) Why has 'Other Expenditure' increased by about Rs. 31 crores from Rs. 1484 crores in Q1 FY15 to Rs. 1515 crores in Q1 FY16?

Answer: Other Expenditure for Q1 FY16 is higher by 2% Vs. Q1 FY15 due to higher advertising spends partly offset by lower logistics costs a/c drop in agri commodity trading volumes.

Q6. Please provide an overview of the Company's progress in the new FMCG businesses. What is the Company's goal in the new FMCG businesses?

Answer: The new FMCG businesses comprising Branded Packaged Foods, Personal Care Products, Education & Stationery Products, Lifestyle Retailing, Incense Sticks (Agarbattis) and Safety Matches have grown at an impressive pace over the past several years, with Segment Revenue crossing the Rs. 9000 crores mark in FY15.

The Company has established a vibrant portfolio of brands which represent an annual consumer spend of over Rs. 11000 crores in aggregate. In terms of annual consumer spend, Aashirvaad and Sunfeast are over Rs. 2000 crores each, Classmate and Bingo! over Rs. 1000 crores each, and Sunfeast YiPPee!, Candyman and Vivel have crossed Rs. 500 crores each. The Company's brands continued to win consumer trust and industry recognition. During FY15, 'Fiama Di Wills Shower Gel' was voted the best shower gel at the Nykaa.com Femina Beauty Awards; 'Vivel' won the Afaqs Buzziest Brand Award where it was ranked No. 1 in the Personal Care category; 'Superia Silk' was ranked as the No. 1 soap on quality and skin moisturising ability among Grade 1 toilet soaps by Consumer Voice, a Government of India recognised comparative product testing organisation; John Players earned the distinction of being featured amongst the top 5 brands in the apparel category in 'Brand Equity - The Most Exciting Brands' list published by The Economic Times. These world-class Indian brands support the competitiveness of domestic value chains of which they are a part, ensuring creation and retention of value within the country.

In line with the corporate strategy of creating multiple drivers of growth, the Company seeks to rapidly scale up the FMCG Businesses leveraging its institutional strengths viz. deep consumer insight, proven brand building capability, a deep and wide distribution network, strong rural linkages and agri commodity sourcing expertise, packaging knowhow and cuisine knowledge. In addition, the Company continues to make significant investments in Research & Development to develop and launch disruptive and breakthrough products in the market place.

Q7. Please provide a revenue split of the FMCG-Others Segment.

Answer: The Branded Packaged Foods Businesses represent the largest component of this segment, accounting for ~70% of Segment Revenue. The Education and Stationery Business accounts for ~10% of Segment Revenues followed by Personal Care Products at ~8%.

Q8. What are the new FMCG categories that the Company is likely to enter over the short to medium term?

Answer: With aspirations to become the No.1 FMCG player in India, the Company continuously evaluates opportunities to grow in the FMCG space.

The choice of category is guided by its growth prospects, profitability profile and the ability of the Company to effectively leverage its institutional strengths with a view to achieving leadership status within a reasonable time frame. Synergies with existing categories in terms of overlap of distribution reach, brand extension possibility, procurement efficiencies etc. are considered while choosing new categories.

Dairy, Tea, Coffee and Chocolates are some of the interest areas in this context.

Q9. What is the margin profile of the Branded Packaged Foods business?

Answer: The Branded Packaged Foods Businesses of the Company comprise Confections, 'Staples, Snacks and Meals' and Dairy & Beverages. These Businesses have evolved over a period of time and are currently at different stages of their lifecycles. As such, the revenue dimensions, cost structures and profitability profiles of each of these businesses are distinct from the other. For example, EBIT margin is in the high single digit range for the Staples business (first full year of launch: 2002/03) while the same is in the low single digit range for the Snack Foods business (first full year of launch: 2007/08) representing upfront investments towards category development and brand building.

Overall, the mandate for each category is to achieve best-in-class margins within a reasonable period of time.

Q10. What is the margin profile of the Personal Care Products Business? When will it break-even?

Answer: The Personal Care Products Business presently comprises the Personal Wash, Deodorising Products and Skin Care categories. The Company continues to make significant investments in this Business primarily in the area of brand building, R&D and product development towards competing effectively with incumbent players comprising firmly entrenched MNCs and domestic companies.

Presently, each category is operating at industry benchmarked gross margins. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins progressively over the medium-term.

Q11. What are the Company's targets in the FMCG-Others space? What does the company envision in terms of revenue and profits in this segment, over the medium and long-term?

Answer: ITC's endeavour is to become the No.1 FMCG player in India driven by the existing portfolio as well as entry into new categories. In this regard, the Company is aiming for a revenue of Rs. 100,000 crores from the new FMCG businesses by the year 2030.

Over the medium term, the Company seeks to grow Revenues of each category within the FMCG-Others segment at a rate which is well ahead of industry. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins, progressively over the medium-term.

Q12. Would ITC contemplate acquisitions in order to achieve its vision in the Other FMCG segment?

Answer: ITC examines prospects for inorganic growth that arise from time to time not only in this business segment but also in the other businesses. The Company continues to evaluate opportunities to grow its businesses through acquisitions and Joint Ventures and is guided by considerations such as strategic fit, valuation, financial viability, ease of integration etc.

In February 2015, the Company acquired the 'Savlon' and 'Shower to Shower' trademarks and other intellectual property rights for identified markets from the Johnson & Johnson group. Savlon is an established brand with a rich heritage and is associated with personal care products in the fast-growing antiseptic/anti-bacterial categories. Shower to Shower has a strong consumer franchise in the prickly heat talcum powder category. The Company intends to leverage these assets to strengthen its position in the personal care space by expanding its existing product portfolio and gaining access to newer consumer segments and markets.

Q13. Please provide an update on the Company's progress in the FMCG-Others Segment during the quarter.

Answer: The Company's FMCG-Others businesses clocked Segment Revenue of Rs. 2171 crores during the quarter, representing a growth of 12.2% over the previous year amidst subdued demand conditions. Segment Results for the quarter stood at Rs. (8) cr. compared to Rs. (16) cr. in the corresponding period last year. Segment Results for the quarter reflects, inter alia, the gestation costs relating to Juices and Gums.

The Branded Packaged Foods Businesses posted healthy growth in revenues during the quarter, despite sluggish demand conditions and regulatory challenges in the Instant Noodles category. In the 'Staples, Snacks and Meals' Business, 'Aashirvaad' atta sustained its high growth trajectory consolidating its leadership position across markets. The 'Bingo!' range of snack foods registered robust growth driven by the finger snacks portfolio comprising the 'Mad Angles', 'Tangles' and 'Tedhe Medhe' sub-brands. The 'Bingo! Yumitos' potato chips portfolio also gained strong traction in the market. In the Instant Noodles category, while sales of 'Sunfeast YiPPee!' noodles recorded robust growth in the initial part of the quarter, regulatory issues largely pertaining to a competitor's products impacted sales in recent weeks. It is pertinent to note that Sunfeast YiPPee! noodles are manufactured in state-of-the-art facilities complying with strict quality and hygiene norms. Stringent tests are conducted at ITC's internal world-class laboratories as well as external laboratories which are FSSAI-approved and also NABL-accredited. In all these tests, Sunfeast YiPPee! noodles have been found to be in compliance with all food safety regulations.

In the Confections Business, the recently launched 'Mom's Magic' premium cookies and 'Yumfills Whoopie Pie' continue to garner increasing consumer franchise. Market standing of the 'Sunfeast Bounce' range of cream biscuits improved further during the quarter with the brand consolidating its position as the largest selling cream brand in the country thereby sustaining the Company's leadership position in the overall creams segment. The Business also migrated the popular range of cookies under a new sub-brand 'HiFi' for sharper positioning in the market.

The 'B Natural' range of juices, which is now available across all target markets, has garnered impressive consumer franchise in a relatively short span of time. The Company seeks to leverage its agri sourcing expertise and deep distribution reach to scale up the brand going forward.

During the quarter, the Personal Care Products Business posted robust revenue growth driven by improved volumes and enriched mix in the Personal Wash and Deodorants categories. The Business augmented its product portfolio with the launch of 'Vivel Neem' in the Personal Wash category and several variants in the Skin Care category under the 'Vivel Cell Renew' brand aimed at addressing specific consumer needs. The recently acquired trademarks 'Savlon' and 'Shower to Shower' have been fully integrated with the existing operations of the Business.

Q14. Please provide an update on the Cigarettes business.

Answer: The legal cigarette industry in India continues to be impacted by a punitive taxation and discriminatory regulatory regime. The operating environment for the legal cigarette industry in India was rendered even more challenging during the year, with two rounds of sharp increase in Excise Duty - in July 2014 and February 2015. This includes a cumulative increase of 115% on filter cigarettes of 'length not exceeding 65 mm', which has widened the price differential between legal and illegal cigarettes and made it extremely difficult for the legal cigarette industry to counter the unabated growth of illegal cigarettes in the country.

Over the last 3 years, the incidence of Excise Duty and VAT on cigarettes, at a per unit level, has gone up cumulatively by 98% and 104% respectively. The combined impact of such sharp increase in Excise Duty and VAT, is exerting severe pressure on legal industry sales volumes.

High incidence of taxation and a discriminatory regulatory regime on cigarettes in India have over the years, led to a significant shift in tobacco consumption to lightly taxed or tax-evaded tobacco products like bidi, khaini, chewing tobacco, gutkha and illegal cigarettes which presently constitute over 88% of total tobacco consumption in the country. Thus, the share of legal cigarettes in overall tobacco consumption has progressively declined from 21% in 1981-82 to below 12% in 2014-15 even as overall tobacco consumption has increased in India. Besides adversely impacting the performance of the legal cigarette industry, this has led to sub-optimisation of the revenue potential from the tobacco sector.

According to a recent independent study, it is estimated that products representing 68% of overall tobacco consumption in the country escape taxation as they are manufactured in the unorganised sector with little statutory oversight. As a result, revenue collections from the tobacco sector are sub-optimised even as the overall tobacco control and health objectives remain substantially unfulfilled. The requirement therefore is an India-centric tax and policy framework for tobacco that cognises for the unique tobacco consumption pattern in the country.

The imposition of discriminatory and punitive VAT rates by some States provides an attractive tax arbitrage opportunity for illegal cigarette trade by criminal elements. The consequential decline in legal cigarette volumes in such States has led to stagnation/decline in revenue collections, even as illegal cigarettes gained significant traction. On the other hand, the pragmatic decisions of several State Governments to rationalise VAT on cigarettes have facilitated improvement in revenue buoyancy and arresting the growth of illegal trade.

According to an independent study conducted by Euromonitor International - a renowned global research organisation - India is now the 5th largest market for illegal cigarettes in the world. In fact, illegal trade comprising smuggled foreign and domestically manufactured tax-evaded cigarettes is estimated to constitute one-fifth of the overall cigarette industry in India resulting in a huge revenue loss of over Rs.7000 crores per annum to the national exchequer.

There is an urgent need for stability in tax rates on cigarettes to reverse the undesirable consequences of a punitive and discriminatory tobacco taxation policy. The Company continues to engage with the concerned authorities, both at the Central Government and State level, highlighting the need for moderation in tax rates on cigarettes to maximize the revenue potential from the tobacco sector and contain the growth of the illegal segment.

Please refer to the FMCG - Cigarettes section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2015 and Media Releases on quarterly results for further details.

Q15. What is the impact of increase in excise duty and VAT on cigarette volumes?

Answer: See response to Q. 14.

Q16. Is the pressure on volumes similar across the different segments i.e. King Size filters, Longs, Regular filters and filter cigarettes of 'length not exceeding 65 mm'?

Answer: While all segments are witnessing pressure on volumes, the Regular Filter segment has been the worst hit.

Q17. What is the Company's view on cigarette volume trends over the medium to long term?

Answer: As aforestated, legal cigarette industry volumes are currently facing unprecedented pressure due to the steep increase in Excise Duty and VAT and the unabated rise in illegal trade.

As highlighted earlier, the share of legal cigarettes in overall tobacco consumption is less than 12% in India. While this indicates room for growth in legal cigarette volumes going forward, this would largely depend on the taxation and regulatory policy on cigarettes adopted by the Government. Such growth potential was demonstrated during the period 2004/05 to 2006/07 and again, more recently, in 2009/10 and 2011/12 - years in which taxes / duties growth was moderate.

A stable, fair and equitable India-centric cigarette taxation and regulatory policy which recognises the unique tobacco consumption pattern in the country is critical to realising the full economic potential of the tobacco sector in India.

The Company continues to engage with the concerned authorities, both at the Central and State Government level, in this regard.

Q18. Are cigarettes likely to be a part of the proposed GST regime? What is the likely rate applicable on cigarettes?

Answer: As per the draft Constitution Amendment Bill 2014 on Goods and Services Tax (GST), cigarettes are likely to come under the purview of the proposed GST framework while continuing to be subjected to the levy of Central Excise Duty.

There is no information as yet on the GST rate. It would be imperative that revenue sensitive goods like cigarettes are subjected to uniform standard rates of tax applicable to general category of goods to ensure revenue buoyancy and rein in the growth of the illegal segment. Further, the combined incidence of Excise Duty and GST should be revenue neutral i.e. maintained at current levels and all existing State level taxes should be subsumed into GST. The Company, along with industry bodies and other stakeholders, continues to make representations to the Government in this regard.

Q19. What is the status on the proposal to introduce larger graphic health warnings on packs?

Answer: A recent Government notification, originally proposed to be effective from 1st April 2015, mandates larger graphic health warnings covering 85% of the surface area of both sides of the pack as compared to the current requirement of covering 40% of the area of one side of the pack. The proposed graphic health warnings are amongst the most stringent in the world and far larger than those in the top 5 cigarette markets viz. China, Russia, Indonesia, USA and Japan.

The Committee on Subordinate Legislation, which is examining the issue of introduction of larger graphic health warnings on cigarette packs in India, has in its report dated 16th March 2015 stated that a large number of representations have been received from Members of Parliament as well as various people/organisations and stakeholders involved in the tobacco industry against the introduction of the new warnings and serious apprehensions have been expressed about the adverse impact of the modified rules on the livelihoods of a large number of people directly or indirectly involved in tobacco trade. The Committee has sought more time to review the issues in detail and has recommended to the Government to defer the implementation of the notification, till such time it finalises the examination of the subject and arrive at appropriate conclusions. The Government has accordingly deferred the implementation of the new graphic health warnings.

Q20. What would be the likely impact on the cigarette industry if larger graphic health warnings on packs are introduced?

Answer: It is apprehended that the introduction of the new graphic health warnings would inter alia lead to a spurt in the sale of illegal cigarettes as the same will not carry the new warnings. Besides the consequential loss of revenue to the exchequer, this will also adversely impact the livelihoods of Indian tobacco farmers as illegal cigarettes either do not use Indian tobacco at all or use domestically sourced tobacco of dubious and inferior quality.

It is estimated that about 60% of the countries in the world which have ratified the WHO Framework Convention on Tobacco Control either do not have any health warnings on cigarette packets or prescribe a 'text-only' warning (i.e. without any graphics). In fact, China, USA and Japan which together account for more than 51% of global cigarette sales volumes, prescribe 'text only' warnings.

The Tobacco industry in India supports the livelihoods of over 41 million people including vulnerable sections of the society like farmers, farm labour, rural poor, women, tribals etc. and contributes around Rs. 28000 crores to the national exchequer apart from generating valuable foreign exchange earnings of around Rs. 6000 crores. It is pertinent to note that other tobacco producing countries have taken a balanced view keeping in mind their domestic interests and have not adopted over-sized and excessive health warnings.

The proposed graphic health warnings would impede the ability to compete in the market by not leaving sufficient space for the Company's distinctive trademarks and pack designs besides depriving consumers of their valuable right to be informed about a legitimate product they intend to purchase and consume.

Q21. What is the status on other amendments proposed to the Cigarettes and other Tobacco Products (Prohibition of Advertisement and Regulation of Trade and Commerce, Production, Supply and Distribution) (Amendment) Act, 2003 (COTPA).

Answer: It is understood that the Government has received a large number of representations from various stakeholders including a large number of farmers, retailers, vendors, workers etc. against the implementation of the proposed amendments. These representations are currently being examined by the Government.

Q22. What is the Company's plans in the ''other tobacco and nicotine products'' space.

Answer: The Company's entered the Nicotine Replacement Therapy (NRT) space with the launch of 'KwikNic' - a Nicotine chewing gum - in August 2013. During FY15, the Company expanded the market presence of KwikNic nicotine chewing gum adding the pharmaceutical channel to the product's distribution footprint. The product has met with encouraging response.

FY15 also saw the Company's foray into the Electronic Vaping Device (EVD) category under the 'EON' brand. After its initial launch in Hyderabad and Kolkata, the brand was progressively extended to Bengaluru, Delhi and Goa. EON is also available in the e-commerce channel.

Q23. Please provide an update on the Company's Hotels business.

Answer: The hospitality sector continues to be impacted by a weak pricing scenario in the backdrop of excessive room inventory in key domestic markets and sluggish macro-economic environment both in India and major source markets. Despite a challenging operating environment, the Business recorded robust growth in revenue driven by improved room occupancies and strong growth in the Food & Beverages segment.

While Segment Revenue registered a growth of 15.7% during the quarter, Segment Results remained muted, reflecting gestation costs of the recently commissioned ITC Grand Bharat, Gurgaon and higher depreciation charge due to revision in useful life of fixed assets in accordance with Schedule II of the Companies Act 2013 with effect from 1st April 2014.

In November 2014, the Business unveiled its latest offering in the super premium segment - ITC Grand Bharat near Gurgaon under a licensing arrangement from Landbase India Ltd. - a wholly- owned subsidiary of the Company. Uniquely positioned as an 'oasis of unhurried luxury', this sprawling 'Luxury Collection' resort is situated in an idyllic expanse amidst the Classic Golf Resort - a 27-hole Jack Nicklaus designed signature golf course - surrounded by the majestic Aravalis and dotted with pristine lakes. ITC Grand Bharat delivers the finest luxury experience to guests with 100 Deluxe Suites and 4 Presidential Villas, a wide range of fine dining restaurants, signature spa 'Kaya Kalp - The Royal Spa', a host of recreational and cultural activities and a world-class meeting/ banqueting venue.

The Company's Hotels Business continues to be rated amongst the fastest growing hospitality chains in the country with over 100 properties under 4 distinct brands -'ITC Hotels' in the Luxury segment, 'WelcomHotel' in the upper-upscale segment, 'Fortune Hotels' in the upscale & mid-market space and 'WelcomHeritage' in the leisure & heritage segment. In addition to these brands, the Business has licensing and franchising agreements for two brands - 'The Luxury Collection' and 'Sheraton' - with Starwood Hotels & Resorts. Construction activity at the luxury hotel projects in Kolkata and Hyderabad is progressing satisfactorily. Requisite approvals are also in place to commence excavation works for the construction of a luxury hotel - ITC Narmada - in Ahmedabad.

In line with the Company's commitment to the 'Triple Bottom Line', the Hotels Business targets a continuous reduction in energy and water consumption levels. Further, the Business continues to enhance usage of renewable energy sources which now stands at 58% of total energy requirements of the Business. The bespoke 'WelcomAqua' water programme has been extended to all properties in the Luxury Collection. These interventions stand testimony to the 'Responsible Luxury' positioning of the Company's Hotels Business and reinforce ITC Hotels' position as the 'greenest luxury hotel chain' in the world.

Please refer to the Hotels section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2015 and Media Releases on quarterly results for further details.

Q24. Please provide an update on the Company's Agri Business.

Answer: During the quarter, Segment Revenue degrew by 29.5% primarily due to lack of export opportunities in wheat and soya. While export of Indian wheat was adversely impacted by lower international prices and poor quality due to unseasonal rains, soya trading opportunities were constrained due to adverse price parity in view of higher crop output in major origins. Robust growth in leaf tobacco exports, on the back of new business development and strengthening trade with existing customers, partially mitigated the impact.

Segment Results, on the other hand, recorded a growth of 15.5% on the back of superior product mix and improved realisations leading to significant improvement in Return on Capital Employed.

The Business continued to provide strategic sourcing support to the Company's Cigarette Business meeting all requirements at competitive prices. Large scale deployment of farm yield enhancing measures, extensive farmer training campaigns on agricultural best practices and sustainable agriculture, and customised growing programmes for non-Flue cured varieties were some of the key initiatives undertaken during 2014-15. These interventions also contributed towards improving the competitive positioning of Indian leaf tobacco in international markets.

The Company's deep rural linkages and expertise in agri commodity sourcing is a critical source of competitive advantage for the Branded Packaged Foods Businesses. Given the volatile market conditions caused by climatic variations, changes in Government policies and global demand-supply dynamics, the Company has invested significantly in building competitively superior agri commodity sourcing expertise comprising multiple business models, geographical spread and customised infrastructure. These capabilities and infrastructure have created structural advantages that facilitate competitive sourcing of agri raw materials for the Company's Branded Packaged Foods Businesses. The Business continues to focus on increasing the efficiency of procurement and logistics operations by consistently pursuing cost optimisation initiatives including reducing distance travelled and eliminating non value-adding activities.

Please refer to the Agri Business section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2015 and Media Releases on quarterly results for further details.

Q25. Please provide an update on the Company's Paperboards, Paper and Packaging Segment.

Answer: The Paperboards, Paper & Packaging segment continued to be impacted by the slowdown in the FMCG and Cigarette industry. Reduction of import duties under various Free Trade Agreements, especially with ASEAN which became effective from 1st January 2014, also weighed on the performance of the domestic Paper and Paperboard industry. Cheap imports from China also impacted the domestic industry. Consequently, during the quarter, the Segment Revenue declined by 1.8% and the Segment Profits degrew by 7.4%.

In the Paperboards and Specialty Papers Business, despite a challenging operating environment and heightened competitive intensity, the Company continued to drive volume growth, improve realisations and sustain its market standing. This was achieved by focusing on identified end-use segments, investments in quality systems and processes, and enhancing customer service levels. The Business consolidated its clear market leadership position in the VAP segment with the entire capacity of the recently commissioned paperboard machine (PM7) being dedicated to the manufacture of VAP grades since the beginning of 2014.

The Company, with its integrated operations and strategic cost management initiatives, was able to minimise the adverse impact of input cost escalations during the year. The recently completed in-house pulp mill expansion project is now fully operational and is performing optimally. To further reduce the dependence of imports, the Business has embarked on setting up India's first Bleached Chemical Thermo-Mechanical Pulp mill at its Bhadrachalam unit. The project is progressing as per schedule.

The integrated nature of the business model comprising access to high-quality fibre from the economic vicinity of the Bhadrachalam mill, in-house pulp mill and state-of-the-art manufacturing facilities coupled with robust forward linkage with the Education and Stationery Products Business and focus on Value Added Paperboards - strategically positions the Business to further consolidate and enhance its leadership status in the Indian Paperboard and Paper industry.

The Packaging and Printing Business recorded robust growth in revenue in the domestic external market and exports, driven by increased offtake by existing customers and new business development. The Company's world-class facility at Haridwar is operating at benchmark standards and has strengthened the Business's ability to service demand in the northern markets more effectively. Capacity and capability in cartons and flexibles manufacturing is being augmented at both its plants in Chennai and Haridwar. These interventions are expected to be completed shortly. During 2014-15, the Business augmented in-house printing cylinder manufacturing capacity at the Haridwar unit for speedier customer order fulfilment and enhanced competitiveness. With investments in world-class technology, best-in-class quality management systems, multiple locations and a wide packaging solutions portfolio, the Packaging and Printing Business has established itself as a one-stop shop offering superior packaging solutions. The Business is well positioned to rapidly grow its external business while continuing to service the requirements of the Company's FMCG businesses.

Please refer to the Paperboards, Paper & Packaging section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2015 and Media Releases on quarterly results for further details.

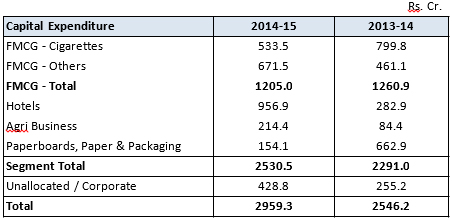

Q26. Please provide details of the Company's Capital expenditure by Business.

Answer: The Company's Capex during the last two financial years is tabulated below:

Q27. Please provide an overview of the capex plan of the Company.

Answer: The Company's capex plans are directed primarily towards capacity gearing, productivity enhancement, ensuring the highest standards in quality and environment, health & safety, and R&D.

One of the key elements of the capex plan going forward is to invest in setting up state-of-the-art owned integrated consumer goods manufacturing and logistics facilities across regions in line with long-term demand forecasts. Currently, over 20 projects are underway and in various stages of development - from land acquisition/site development to construction of buildings and other infrastructure.

In the Hotels Business, the Company is progressing the construction of new hotels in Kolkata, Hyderabad, Ahmedabad and Coimbatore. Besides, WelcomHotels Lanka Private Ltd. - a wholly-owned subsidiary of the Company - is developing a mixed-use project in Colombo.

The major items of capital expenditure in the Paperboards, Paper and Packaging segment going forward comprise paperboards & specialty paper capacity augmentation/machine rebuild at the Bhadrachalam, Kovai and Tribeni units, investments in setting up a state-of-the-art Bleached Chemical Thermo-Mechanical pulp line at the Bhadrachalam unit, capacity augmentation in Cartons and Flexibles packaging at the Haridwar and Tiruvottiyur units.

Overall, the Company estimates capex of appx. Rs. 25000 crores over the next 5 years (excluding investments for inorganic growth and acquisition of intellectual property/trademarks etc.). However, this would depend on several factors such as a pick-up in economic activity and improvement in demand conditions, timely acquisition of land at appropriate locations, obtaining approvals from the concerned authorities in a timely manner etc.

Q28. What is the rationale for the Company's investments in the FMCG space?

Answer: ITC's entry into a wider range of FMCG products in recent years is in line with its strategy of creating multiple drivers of growth. The Indian FMCG industry is expected to grow rapidly driven by increasing affluence, urbanisation and a young workforce on the one hand and relatively low levels of penetration and per capita usage on the other. The Company seeks to participate in the exciting growth prospects of the FMCG industry by leveraging its institutional strengths namely, deep consumer insight, proven brand building capability, manufacturing excellence, deep and wide distribution network, packaging and printing knowhow, agri commodity sourcing expertise and cuisine knowledge.

Q29. Why has the Segment Capital Employed increased by Rs. 883 crores from Rs. 20431 crores as at 30th June 2014 to Rs. 21314 crores as at 30th June 2015?

Answer: The increase in Segment Capital Employed was primarily on account of higher Net Fixed Assets (net of depreciation) towards capacity augmentation in FMCG businesses, ongoing investments in Hotels, and cost reduction related investments in Paperboards, Paper and Packaging business. Working capital on the other hand has reduced as compared to last year primarily due to lower credit extended to customers and decrease in inventory holding of agri commodities.

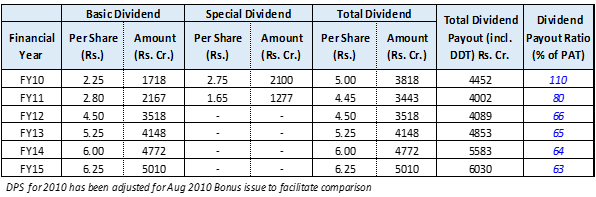

Q30. What are the dividend payout trends in recent years? What is the Dividend policy of the Company?

Answer: Dividend paid out by the Company for the last 5 years is given below:

The Company does not have a stated Dividend policy. Dividend payouts are decided by the Board on an annual basis.

Q31. Please explain the Company's 'Triple Bottom Line' philosophy

Answer: The Company's vision to sub-serve larger national priorities and create enduring societal value is the inspiration for its multi-dimensional sustainability initiatives that are today acknowledged as global exemplars. The Company's sustainability strategy aims to significantly enhance value creation for the nation through superior 'Triple Bottom Line' performance that builds and enriches the country's economic, environmental and societal capital. It is premised on the belief that the transformational capacity of business can be effectively leveraged to create significant societal value through a spirit of innovation and enterprise.

The Company's models of sustainable development and value chains designed to promote livelihoods have supported the creation of around 6 million sustainable livelihoods, largely among the marginalised sections of society. The Company has sustained its position of being the only Company in the world of comparable dimensions to have achieved the global environmental distinction of being carbon positive (for 10 consecutive years), water positive (for 13 years in a row) and solid waste recycling positive (for 8 years in succession).

The Company's renewable energy portfolio ensures that over 43% of its total energy requirements are met from renewable energy sources - a remarkable achievement given the large manufacturing base of the Company. Further, premium luxury hotels, several office complexes and factories of the Company are LEED® (Leadership in Energy & Environmental Design) certified at the highest level by the US Green Building Council/Indian Green Building Council and the Bureau of Energy Efficiency (BEE) under its star rating scheme.

The Company's 12th Sustainability Report, published during the quarter detailed the progress made across all dimensions of the 'Triple Bottom Line' for the year 2014-15. The Company's Sustainability Report in conformance with the new Global Reporting Initiative (GRI) G4 Guidelines was amongst the first in India under "In Accordance - Comprehensive" category with "Materiality Matters" confirmation from GRI and also the first in India that has been third party assured at the highest criteria of "reasonable assurance" as per International Standard on Assurance Engagements (ISAE) 3000.

In addition, the Business Responsibility Report (BRR), as mandated by the Securities & Exchange Board of India (SEBI), was brought out as an annexure to the Report and Accounts 2015, mapping the sustainability performance of the Company against the reporting framework suggested by SEBI.

Q32. Please provide an update of the Company's Corporate Social Responsibility Programme.

Answer: The Company's Corporate Social Responsibility (CSR) programme aims to address the challenges arising out of poverty, environmental degradation and climate change through a range of activities with the overarching objective of creating sustainable sources of livelihood for stakeholders many of whom represent the poorest in rural India.

The footprint of the Company's CSR programme has spread to 71 districts across the country and can be viewed at a glance in the following chart:

| Intervention Areas | Unit of Measurement | Cumulative till 14-15 |

|---|---|---|

| Total Districts Covered | Number | 71 |

| Social and Farm Forestry Soil and Moisture Conservation Programme |

Hectare Hectare |

198,363 212,282 |

| Sustainable Agricultural Practices Compost Units |

Number | 24,595 |

| Sustainable Livelihoods Initiative Cattle Development Centres Animal Husbandry Services |

Number Artificial Inseminations (in lakhs) |

256 15.95 |

| Economic Empowerment of Women Self Help Group Members Livelihoods created |

Persons Persons |

24,484 45,183 |

| Primary Education Beneficiaries |

Children ( in lakhs) | 4.22 |

| Health and Sanitation Low Cost Sanitary Units |

Number | 8,353 |

| Vocational Training Students Enrolled |

Number | 22,088 |