Q1 FY19 Results Update and Frequently Asked Questions

Q1. What is ITC's Vision and Mission?

Answer:

Vision:

Sustain ITC's position as one of India's most valuable and admired corporations through world-class performance, creating growing value for the Indian economy and the Company's stakeholders.

Mission:

To enhance the wealth generating capability of the enterprise in a globalising environment, delivering superior and sustainable stakeholder value.

Q2. How does the Company effectively manage a highly diversified business portfolio? What is the Company's Corporate Governance structure?

Answer: ITC's 'Strategy of Organisation' is crafted in a manner that enables focus on each business while harnessing the diversity of the portfolio to create unique sources of competitive advantage. Please refer to the following link http://www.itcportal.com/about-itc/values/corporate-governance-structure.aspx for details of ITC's 3-tier Governance Structure.

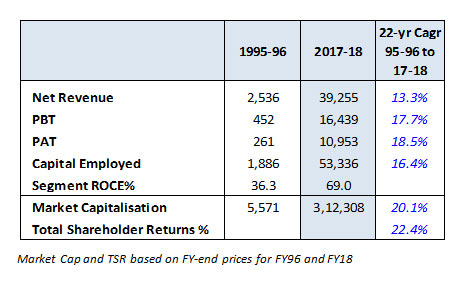

Q3. What is the Company's shareholder value creation track record?

Answer: ITC has been a consistent performer in terms of shareholder value creation. During the period 1995/96 to 2017/18, Total Shareholder Returns have clocked compound annual growth rate of 22.4% significantly outperforming the Sensex (10.9%).

Q4. (a). Why has reported Gross Revenue from sale of products and services declined by 21.9% in Q1 FY19 as compared to Q1 FY18?

Answer: Consequent to the introduction of Goods and Services Tax (GST) with effect from 1st July 2017, Central Excise [other than National Calamity Contingent Duty (NCCD) on cigarettes], Value Added Tax (VAT) etc. have been replaced by GST. In accordance with Indian Accounting Standard - 18 on Revenue and Schedule III of the Companies Act, 2013, GST, GST Compensation Cess, VAT, etc. are excluded and NCCD is not excluded from Gross Revenue from sale of products and services for applicable periods. In view of the aforesaid restructuring of indirect taxes, Gross Revenue from sale of products and services for the quarter ended 30th June, 2018 is not comparable with the previous periods.

Q4. (b). What is the growth in Revenue for the quarter on a comparable basis?

Answer: On a comparable basis, Gross Sales Value (net of rebates/discounts) ('GSV') for the quarter grew by 13.5%. Gross Sales Value includes Gross Revenue from sale of products and services and GST, GST Compensation Cess, Service Tax, VAT, Luxury Tax etc., as applicable for the reported periods.

Q4. (c). What is the growth in FMCG - Others - Segment EBITDA in Q1 FY19 as compared to Q1 FY18?

Answer: In respect of FMCG-Others segment, earnings before interest, taxes, depreciation and amortization (EBITDA), for Q1 FY19 is at Rs. 127.76 Crores vis a vis Rs. 68.80 Crores for Q1 FY18.

Q5. Please provide a brief overview of Q1 FY19 results.

Answer: The Company delivered a healthy performance during the quarter amidst subdued demand conditions and continuing pressure on the legal cigarette industry. On a comparable basis, Gross Sales Value (net of rebates/discounts) for the quarter stood at Rs. 18171.66 Crores, representing a growth of 13.5% driven mainly by the Agribusiness, FMCG-Others and FMCG-Cigarettes Segments. Profit Before Depreciation, Interest and Tax at Rs. 4202.12 Crores and Profit After Tax at Rs. 2818.68 Crores grew by 12.2% and 10.1% respectively. Total Comprehensive Income stood at Rs. 2897.10 Crores (previous year Rs. 2717.32 Crores). Earnings Per Share for the quarter stood at Rs. 2.31 (previous year Rs. 2.11).

Q6. (a). Why has 'Consumption of Raw Material etc. (net)' increased by Rs. 273 Crores during Q1FY19 as compared to Q1 FY18?

Answer: Consumption of Raw Material etc. (net) includes Excise Duty on changes on Inventory. Excluding the same and adjusting for the higher share of agri business, the increase in cost is in line with growth in revenue.

Q6. (b). Why has 'Other Expenditure' decreased by about Rs. 45 Crores from Rs. 1698 Crores in Q1 FY18 to Rs. 1653 Crores in Q1 FY19?

Answer: Other Expenditure for FY19 is lower mainly due to lower Rates & Taxes and Miscellaneous expenses partly offset by higher Outward Freight & Handling Charges and Advertising & Sales promotion expenses.

Q7. What is the rationale for the Company's investments in the FMCG space?

Answer: ITC's entry into a wider range of FMCG products in recent years is in line with its strategy of creating multiple drivers of growth. The Indian FMCG industry is expected to grow rapidly driven by increasing affluence, urbanisation and a young workforce on the one hand and relatively low levels of penetration and per capita usage on the other. The Company seeks to participate in the exciting growth prospects of the FMCG industry by leveraging its institutional strengths in the form of deep consumer insight, proven brand building capability, manufacturing excellence, deep and wide distribution network, packaging and printing knowhow, agri-commodity sourcing expertise and cuisine knowledge.

Q8. Please provide an overview of the Company's progress in the new FMCG businesses. What is the Company's goal in the new FMCG businesses?

Answer: The FMCG industry faced another challenging year in 2017-18 with demand conditions remaining sluggish for the fifth year in a row. The slowdown in the broader economy, as reflected by the marked deceleration in nominal GDP and private consumption expenditure growth, headwinds in rural demand and supply chain disruptions during the transition to the GST regime were manifest in the Company's operating segments in the FMCG space. The year also witnessed commodity prices settling at an elevated level, exerting pressure on margins. While it is anticipated that the FMCG industry will take a few more quarters for demand revival to play out fully, the green shoots of economic recovery and expectations of normal monsoons augur well for the industry. The structural drivers of long-term growth such as increasing affluence and consumer awareness, a young and expanding workforce, increasing urbanisation, Government's thrust on infrastructure development and the rural sector, implementation of GST amongst others, remain firmly in place and the FMCG industry is poised for rapid growth in the ensuing years.

Despite the challenging conditions prevailing in 2017-18, the Company's FMCG-Others Businesses' Segment Revenue at Rs. 11329 Crores grew ahead of industry and recorded an increase of 11.3% (on a comparable basis) on a relatively firm base. While the second half of 2016-17 witnessed reduced consumer offtake and trade pipelines in the wake of adverse liquidity conditions, the Company's FMCG-Others Businesses were relatively less impacted. Most major categories enhanced their market standing during the year. While 'Bingo!' snacks, 'Aashirvaad' atta and 'Dark Fantasy Choco Fills' premium cream biscuits were the key drivers of growth in the Branded Packaged Foods Businesses, 'Engage' deodorants, 'Vivel'/'Fiama' soaps & shower gels and 'Savlon' handwash fuelled strong growth in the Personal Care Products Business.

The Education and Stationery Products Business posted a robust performance in FY 17-18 led by 'Classmate' notebooks, which consolidated its leadership position in the industry. However, the performance of the Lifestyle Retailing Business remained sluggish mainly on account of an early and prolonged 'end-of-season' sale in the wake of disruption to the trade during transition to GST and ongoing structural interventions to enhance operating efficiencies. Segment Results for the year 2017-18 improved to Rs. 164 Crores from Rs. 28 Crores in 2016-17 driven by enhanced scale, product mix enrichment and strategic cost management initiatives after absorbing the impact of sustained investment in brand building, gestation costs of new categories viz. Juices, Dairy, Chocolates and Coffee and costs associated with the ongoing structural interventions in the Lifestyle Retailing Business.

The Company continued to make investments during the year towards enhancing brand salience and consumer connect while simultaneously implementing strategic cost management measures across the value chain. Several initiatives were also implemented during the year towards leveraging the rapidly growing e-commerce channel with a view to enhancing the reach of Company's products and harnessing digital and social media platforms for deeper consumer engagement.

In FY 17-18, the Company commissioned two world-class Integrated Consumer Goods Manufacturing and Logistics Units (ICMLs) at Panchla, West Bengal and Kapurthala, Punjab. Significant progress was also made in constructing several other state-of-the-art owned ICMLs across the country to secure capacity and enable the FMCG Businesses to rapidly scale up in line with long-term demand forecast. Currently, over 15 projects are underway and in various stages of development - from land acquisition/site development to construction of buildings and other infrastructure. The Businesses are focussing on deploying 'Industry 4.0' technologies including advanced analytics, big data and industrial Internet of Things (IoT) in areas such as overall equipment efficiency, energy management, maintenance, downtime analysis, quality and traceability.

The FMCG Businesses comprising Branded Packaged Foods, Personal Care Products, Education and Stationery Products, Lifestyle Retailing, Incense Sticks (Agarbattis) and Safety Matches have grown at an impressive pace over the past several years.

Today, the Company's vibrant portfolio of brands represents an annual consumer spend of nearly Rs. 16000 Crores in aggregate. These brands have been built organically over a relatively short period of time - a feat unparalleled in the Indian FMCG industry. In terms of annual consumer spend, 'Aashirvaad' is today over Rs. 4000 Crores; 'Sunfeast' over Rs. 3500 Crores; 'Bingo!' over Rs. 2000 Crores; 'Classmate' & 'YiPPee!' are over Rs. 1000 Crores each and 'Vivel', 'Mangaldeep' & 'Candyman' are over Rs. 500 Crores each. These world-class Indian brands support the competitiveness of domestic value chains of which they are a part, ensuring creation and retention of value within the country.

The Company's FMCG brands have achieved impressive market standing in a relatively short span of time. Today, Aashirvaad is No. 1 in Branded Atta, Bingo! is No. 1 in Bridges segment of Snack Foods (No.2 overall), Sunfeast is No. 1 in the Premium Cream Biscuits segment, Classmate is No. 1 in Notebooks, YiPPee! is No. 2 in Noodles, Engage is No. 2 in Deodorants (No. 1 in women's segment) and Mangaldeep is No. 2 in Agarbattis (No. 1 in Dhoop segment).

The Company remains extremely agile and responsive to the emerging trends shaping the future of the industry. Some of the noteworthy consumer trends include the emergence of health and wellness products as a key consumer need; increasing preference for products rooted to 'Indianness' and with regional/cultural connects; increasing need for customised products and bespoke experiences; growth in demand for 'on-the-go' consumption formats and rising influence of social media and digitalisation on consumer preferences and shopping behaviour. Similarly, the FMCG market construct is likely to undergo rapid change driven by exponential growth in tier - II/III towns and rural India and the emergence of relatively new channels such as Modern Trade and e-commerce.

The Indian FMCG market is at an inflection point and the Company seeks to rapidly scale up the FMCG Businesses leveraging its institutional strengths viz. deep consumer insight, proven brand building capability, agri-commodity sourcing expertise, cuisine knowledge, strong rural linkages, a deep and wide distribution network and packaging know-how. In addition, the Company continues to make significant investments in Research & Development, focus on consumer insight discovery and harness digital technology to develop and launch disruptive and breakthrough products in the market place.

Q9. Please provide a revenue split of the FMCG-Others Segment.

Answer: The Branded Packaged Foods Businesses represent the largest component of this segment, accounting for ~76% of Segment Revenue. The Personal Care Business and Education and Stationery Products Business account for ~9% and ~8% each of Segment Revenues respectively.

Q10. What are the new FMCG categories that the Company is likely to enter over the short to medium term?

Answer: With aspirations to become the No.1 FMCG player in India, the Company continuously evaluates opportunities to grow in the FMCG space.

The choice of category is guided by its growth prospects, profitability profile and the ability of the Company to effectively leverage its institutional strengths with a view to achieving leadership status within a reasonable time frame. Synergies with existing categories in terms of overlap of distribution reach, brand extension possibility, procurement efficiencies etc. are considered while choosing new categories.

The Company is in the process of scaling up its presence in Dairy & Beverages, Chocolates and Coffee.

Q11. What is the margin profile of the Branded Packaged Foods Business?

Answer: The Branded Packaged Foods Businesses of the Company comprise 'Confections', 'Staples, Snacks and Meals' and 'Dairy & Beverages'. These Businesses have evolved over a period of time and are currently at different stages of their lifecycles. As such, the revenue dimensions, cost structures and profitability profiles of each of these businesses are distinct from the other. For example, EBIT margin is in the high single digit range for the Staples business (first full year of launch: 2002/03) while the same is in the mid-single digit range for the Snack Foods business (first full year of launch: 2007/08) representing upfront investments towards category development and brand building.

Overall, the mandate for each category is to work towards achieving best-in-class margins within a reasonable period of time.

Q12. What is the margin profile of the Personal Care Products Business? When will it break-even?

Answer: The Personal Care Products Business presently comprises the 'Personal Wash', 'Fragrancing Products', 'Skin Care', 'Antiseptic Liquid' and 'Floor Cleaner' categories. The Company continues to make significant investments in this Business primarily in the area of brand building, R&D and product development towards competing effectively with incumbent players comprising firmly entrenched MNCs and domestic companies.

Presently, each category is operating at industry benchmarked gross margins. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins progressively over the medium-term.

Q13. What are the Company's targets in the FMCG-Others space? What does the Company envision in terms of revenue and profits in this segment, over the medium and long-term?

Answer: ITC's endeavour is to become the No.1 FMCG player in India driven by the existing portfolio as well as entry into new categories. In this regard, the Company is aiming for revenue of Rs. 100,000 Crores from the new FMCG businesses by the year 2030.

Over the medium term, the Company seeks to grow revenues of each category within the FMCG-Others segment at a rate which is well ahead of industry. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins, progressively over the medium-term.

Q14. Would ITC contemplate acquisitions in order to achieve its vision in the Other FMCG segment?

Answer: ITC examines prospects for inorganic growth that arise from time to time not only in this business segment but also in the other businesses. The Company continues to evaluate opportunities to grow its businesses through Acquisitions and Joint Ventures and is guided by considerations such as strategic fit, valuation, financial viability, ease of integration etc.

The Company's 'Savlon' and 'Shower to Shower' brands, acquired earlier, have been leveraged to strengthen its position in the personal care space by expanding its existing product portfolio and gaining access to newer consumer segments and markets. The offerings have garnered significant consumer franchise and are well poised for rapid growth.

Face-equity of the 'Charmis' brand, acquired by the Company in FY18, has been leveraged to launch moisturising skin cream.

The quarter also marked the Business's foray into the floor cleaner segment under the recently acquired 'Nimyle' brand. Plans are on the anvil to scale up the brand's presence in existing markets and extend the same to other target markets progressively.

Q15. Please provide an update on the Company's progress in the FMCG-Others Segment during the quarter.

Answer: Segment Revenue grew by 14.3% during the quarter on a relatively firm base (based on Gross Sales Value which includes adjustments only for taxes that are excluded from reported Gross Revenue). This was led by Staples, Snacks and Meals Business in the Branded Packaged Foods Business, Deodorants and Liquids (handwash & bodywash) in the Personal Care Products Business, Classmate Notebooks and Agarbattis offset by the ongoing restructuring of retail footprint and trade presence in the Lifestyle Retailing Business.

Segment EBITDA at Rs. 127.76 Crores registered robust growth of 86% on the back of enhanced scale, product mix enrichment and cost management initiatives, despite sustained investment in brand building and gestation costs of new categories viz. Juices, Dairy, Chocolates, and Health & Hygiene segment in the Personal Care Products Business.

The Branded Packaged Foods Businesses posted robust growth in revenue with most major categories recording improvement in market standing.

-

In the Staples, Snacks and Meals Business, Aashirvaad atta staged progressive recovery after the concerted attack on the brand by rumour mongers in the previous quarter, and consolidated its leadership position across markets. Increasing consumer traction for Bingo! Potato Chips and Tedhe Medhe continued to drive growth in the Snacks Business. During the quarter, the Business introduced several innovative variants in the market including Mad Angles Fillos, a first-to-market snack format with peanut masala filing, Mad Angles Very Peri Peri and Tedhe Medhe Wakhra, inspired by the popular pickle flavours from the city of Amritsar. In the Instant Noodles Category, YiPPee! Magic Masala continued to garner consumer franchise anchored on superior quality and a differentiated value proposition. Product portfolio stood augmented with the launch of 'Wow Chicken' - a unique offering which can be consumed in both dry and cooked formats - in West Bengal and North East markets. The new products have received encouraging response and are being rolled out to target markets.

-

In the Confections Business, Dark Fantasy Choco Fills and Mom's Magic range of premium cookies accelerated their growth momentum driven by superior product attributes, focused communication and consumer activation. During the quarter, the Business forayed into the fast-growing Cakes segment with the launch of 2 exciting variants each under the Dark Fantasy Choco Jellifills and Bounce brands. The Biscuits portfolio was augmented with the launch of Bounce Minis strawberry flavoured bite-sized centre-filled biscuits and Marie Light Vita, a variant enriched with 11 essential nutrients. Portfolio premiumisation continued in the Confectionery category with higher salience of 'Re.1 and above' products in the sales mix. During the quarter, the Business launched a differentiated offer - Candyman Fruitee Delite.

-

In the Dairy & Beverages Business, B Natural juices scaled up volumes during the quarter leveraging a portfolio of differentiated products anchored on the 'Not from Concentrate' platform. This initiative not only provides consumers a more nutritive and natural tasting experience but also promotes the use of fruit pulp procured from Indian farmers, thereby supporting the Indian farm and food processing sector. The juices portfolio was augmented during the quarter with the launch of Chatpata Phalsa and Masala Jamun variants tailored to regional tastes and preferences.

-

Product portfolio of the Fabelle range of luxury chocolates was strengthened with the introduction of Choco Mousse with Nuts & Berries, a premium centre-filled chocolate bar with visible inclusions. The Business also introduced the range in several Modern Trade and premium outlets across Bengaluru in addition to the exclusive Fabelle chocolate boutiques in 8 ITC hotels. Fabelle continues to receive excellent response from discerning consumers setting a new benchmark in the luxury chocolates segment.

The Personal Care Products Business enhanced its market standing during the quarter with robust growth in sales of fragrancing products and liquids (handwash and bodywash). The Business launched several new products during the quarter including Engage ON+ pocket perfume for men in a unique slider-flip pack, Savlon hand sanitiser gel, a range of bathing accessories under the Fiama brand and a premium range of anti-ageing, specialised hydrating creams, cleansing and toning products under the 'Dermafique' brand. Dermafique has been developed at the Company's state-of-the-art Life Sciences and Technology Centre leveraging the latest breakthroughs in bioscience, nanotechnology and derma science. Vivel body wash, launched in the previous quarter in two natural variants - Lavender Almond Oil & Mint Cucumber, continued to receive excellent response in the launch markets. The quarter also marked the Business's foray into the floor cleaner segment under the recently acquired 'Nimyle' brand. Plans are on the anvil to scale up the brand's presence in existing markets and extend the same to other target markets progressively.

The Business continued to focus on deepening consumer engagement through innovative brand campaigns in conventional and social media platforms. During the quarter, Savlon's unique 'Healthy Hands Chalk Sticks' campaign won the prestigious Grand Prix for 'creative effectiveness' at the Cannes Lions 2018 while Vivel leveraged its 'Ab Samjhauta Nahin' campaign to lead the conversation on legal rights for gender equality with renowned Supreme Court advocate Ms. Karuna Nundy explaining how laws can protect women at home and at work.

The Branded Packaged Foods and Personal Care Products Businesses continue to leverage state-of-the-art integrated consumer goods manufacturing facilities (ICML) to service proximal markets in a highly efficient and responsive manner. Capacity utilisation was scaled up at the recently commissioned ICMLs at Kapurthala, Panchla and Guwahati. Over 15 projects are underway and in various stages of development - viz. land acquisition/site development, construction of buildings, equipment installation and other infrastructure.

The Education and Stationery Products Business strengthened its leadership position in the Notebooks category leveraging a portfolio of innovative products and superior quality. During the quarter the Business launched the 'MyClassmate App' towards enhancing consumer connect. The App contains several useful features for students such as modules pertaining to subject concepts, personal timetable organiser & metrics converter and has received encouraging initial response with excellent ratings from users. The unique Classmate 'Be Better Than Yourself' campaign, launched recently, continued to promote conversations amongst parents on the critical topic of supporting children to pursue their ambitions and has garnered wide followership across social media platforms. Aimed at driving tangible changes in society by encouraging children to realise their full potential by pursuing their personal goals and ambitions rather than comparing them with peers in terms of their marks and other achievements, the campaign has aided in deepening consumer connect and driving brand preference.

Please refer to the FMCG - Others section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2018 and Media Releases on quarterly results for further details.

Q16. Please provide an update on the Cigarettes business.

Answer: A punitive and discriminatory taxation and regulatory regime continues to exert severe pressure on the domestic legal cigarette industry even as illegal cigarette trade grows unabated.

The legal cigarette industry, already reeling under the cumulative impact of steep increase in taxation over the last five years and intense regulatory pressures, was further impacted by a sharp increase of 13% in tax incidence on cigarettes (19% increase for the king-size filter segment) under the GST regime. Coupled with the increase in Excise Duty rates announced in the Union Budget 2017, this resulted in an incremental tax burden of over 20% on the Cigarette Business post implementation of GST.

It is pertinent to note that the tax incidence on cigarettes has nearly trebled over the last six years, on a comparable basis. The high rates of tax on cigarettes also provide attractive tax arbitrage opportunities to unscrupulous players, fanning the growth of illegal cigarette trade in the country. While the legitimate cigarette industry has declined steadily since 2010-11 at a compound annual rate of 4.8% p.a., illegal cigarette volumes in contrast have grown at about 5% p.a. during the same period, making India one of the fastest growing illegal cigarette markets in the world. It may be noted that, according to Euromonitor International, India is now the 4th largest illegal cigarette market in the world.

Another factor that fuels the growth of smuggled international brands is that such cigarette packs do not carry the excessively large (85% of the surface area of both sides of the cigarette package) pictorial warnings with extremely gruesome and unreasonable images that are prescribed under Indian laws. While the legal cigarette industry scrupulously complies with the statutory provisions, smuggled international brands of cigarettes either do not bear any pictorial or other health warnings or bear warnings of much smaller dimensions, that too different from what is mandated under Indian law. Findings from research conducted by IMRB International, an independent organisation, indicate that the lack of warnings or their diminutive size creates a perception in the consumer's mind that the smuggled cigarettes are 'safer' than domestic duty-paid cigarettes that carry the statutory warnings. The attractive tax arbitrage opportunity for smuggled cigarettes allows unscrupulous players to make the products available to consumers at a fraction of the price of duty-paid domestic cigarettes. In fact, the affordability of illegal cigarettes and the other cheaper tobacco products (by reason of lower tax incidence as well as evasion of taxes) has been driving the consumption of tobacco from duty-paid cigarettes to the other forms.

The growth of smuggled international brands has also adversely impacted the demand for domestic Flue Cured Virginia (FCV) tobacco that is used in cigarette manufacture. The absence of a strong domestic demand base has not only resulted in loss of income but also exposed the Indian tobacco farmer to the volatilities of the international market, thereby sub-optimising earnings from tobacco crop exports as well. These developments have had a devastating impact on the Indian tobacco farmer and the 47 million livelihoods dependent on the tobacco value chain. Soft demand for Indian FCV tobacco has prompted the Tobacco Board of India to reduce the authorised crop size for three successive years i.e. 2015-16, 2016-17, 2017-18. Further, the unprecedented drought in Andhra Pradesh in late 2016 played havoc on the actual crop output in 2017 besides adversely impacting its quality. This, in turn, has also led to lower exports of tobacco. It is estimated that the cumulative drop in farmer earnings is in excess of Rs. 3450 Crores over the last three years, i.e., an average loss in earnings of over Rs. 1150 Crores per year.

As reported last year, ITC and several other stakeholders had challenged the validity of the pictorial warnings. Based on a direction of the Supreme Court, all litigation on pictorial warnings were tagged together and heard by the High Court of Karnataka. The High Court, by its judgement in December 2017 held the 85% pictorial warnings with extremely gruesome imagery to be factually incorrect and unconstitutional. Upon a Special Leave Petition filed by the Government, the Honourable Supreme Court stayed the Order of the High Court. Pending the final hearing of this matter, the regime of the extremely repugnant 85% pictorial warnings continues.

Although India is the 3rd largest tobacco grower in the world, it has put in place extremely stringent tobacco control laws. For instance, the statutorily prescribed pictorial warning occupying 85% of both sides of a cigarette pack ranks India in the 2nd position globally in terms of their stringency. Unfortunately, these laws have fuelled, albeit unintentionally, the growth of illegal cigarettes in the country and consequently, impacted adversely on farmer incomes. In contrast, several major tobacco producing countries, including the USA, have taken into consideration the interests of their tobacco farmers in deciding whether or not to adopt large or excessive pictorial warnings. The Indian tobacco control laws have, thus, had the inadvertent and unforeseen effect of causing losses to the Indian farmer with corresponding gains to tobacco farmers in the countries that have opted for moderate and equitable tobacco control laws.

Despite an extremely challenging operating environment, the Business consolidated its leadership position in the industry and continued to improve its standing in key competitive markets across the country. This demonstrates the resilience of the Company's portfolio of brands, superior consumer insights and its relentless focus on value creation. Some of the key interventions during the quarter include the launch of innovative variants viz., Hollywood (triple segment filter) and Flake Taste Pro (dual segment filter). Additionally, two brands, American Club and Players, which were launched towards the end of 2016-17 continue to be scaled up.

The research and development initiatives of the Company continue to add to the country's bank of Intellectual Property Rights (IPR). In addition to grant of several patents in previous years, the Company was granted three more patents during the year 17-18 - two international and one national - in respect of cigarettes.

Please refer to the FMCG - Cigarettes section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2018 and Media Releases on quarterly results for further details.

Q17. What is the Company's view on cigarette volume trends over the medium to long term?

Answer: As aforestated, the tax incidence on cigarettes, after cognising for the latest increase in Cess rates, has nearly trebled over the last six years, on a comparable basis.

As highlighted earlier, while overall tobacco consumption in the country continues to grow, the share of duty-paid cigarettes has come down substantially over the years and is estimated to account for around 10% of current tobacco consumption in the country. Despite accounting for such a low share of overall tobacco consumption in the country, the legal cigarette industry contributes more than 87% of tax revenue from the tobacco sector. The other types of tobacco products contribute barely 13% of tax revenue from the tobacco sector despite accounting for 90% of total tobacco consumption.

While this indicates room for growth in legal cigarette volumes going forward, this would largely depend on the taxation and regulatory policy on cigarettes adopted by the Government. Such growth potential was demonstrated during the period 2004/05 to 2006/07 and again, more recently, in 2009/10 and 2011/12 - years in which taxes / duties growth were moderate.

A stable, fair and equitable India-centric cigarette taxation and regulatory policy which recognises the unique tobacco consumption pattern in the country is critical to realising the full economic potential of the tobacco sector in India.

The Company continues to engage with the concerned authorities, both at the Central Government and State level, in this regard.

Q18. At what rate are Cigarettes taxed under the GST regime? What is the impact of GST on Cigarettes Business?

Answer: Cigarettes are exigible to tax under the GST regime at the peak rate of 28%. Additionally, a GST Compensation Cess which includes an Ad Valorem component and a Specific Tax component based on cigarette length, has also been imposed. The National Calamity Contingent Duty (NCCD) component of Excise Duty continues to be levied as earlier based on the length of the cigarette.

Please see response to question no. 16 for impact of GST on Cigarette Business.

Q19. What is the impact of the larger graphic health warnings on packs on the cigarette industry?

Answer: The 85% GHW is excessively large, extremely gruesome and unreasonable. There is no evidence that cigarette smoking would cause the diseases depicted in the pictures or that large GHW will lead to reduction in consumption. The large GHW fuels the growth of smuggled international brands as such cigarette packs do not carry the excessively large (85% of the surface area of both sides of the cigarette package) pictorial warnings with extremely gruesome and unreasonable images that are prescribed under Indian laws. While the legal cigarette industry scrupulously complies with the statutory provisions, smuggled international brands of cigarettes either do not bear any pictorial or other health warnings or bear warnings of much smaller dimensions, that too different from what is mandated under Indian law. Findings from research conducted by IMRB International, an independent organisation, indicate that the lack of warnings or their diminutive size creates a perception in the consumer's mind that the smuggled cigarettes are 'safer' than domestic duty-paid cigarettes that carry the statutory warnings.

It is pertinent to note that the global average size of pictorial warnings is only about 30% coverage of the principal display area. In fact, the three countries that account for about 51% of the world's cigarette consumption, viz., USA, Japan and China have not adopted pictorial / graphical warnings and have prescribed only text-based warnings on cigarette packages. The statutorily prescribed pictorial warning occupying 85% of both sides of a cigarette pack ranks India in the 2nd position globally in terms of their stringency Unfortunately, these laws have fuelled, albeit unintentionally, the growth of illegal cigarettes in the country.

The excessively large GHWs prevent consumers from making an informed choice in a competitive market, since they are denied adequate information about the brand on the cigarette packages. The Company believes that such GHW also devalues the Intellectual Property Rights of brand owners and sub-optimises the large investments made over the years in creating and nurturing the brands.

Q20. Please provide an update on the Honourable Karnataka High Court order relating to 85% graphic health warnings on tobacco product packages.

Answer: As reported last year, the Company and several other stakeholders had challenged the validity of the pictorial warnings. Based on a direction of the Honourable Supreme Court, all litigation on pictorial warnings were tagged together and heard by the Honourable High Court of Karnataka. The Honourable High Court, by its judgement in December 2017 held the 85% pictorial warnings with extremely gruesome imagery to be factually incorrect and unconstitutional. Upon a Special Leave Petition filed by the Government, the Honourable Supreme Court stayed the Order of the High Court. Pending the final hearing of this matter, the regime of the extremely repugnant 85% pictorial warnings continues.

Q21. What are the Company's plans in the 'other tobacco and nicotine products' space?

Answer: In the year 17-18, the Electronic Vaping Devices portfolio was augmented with the launch of EON Myx, a disposable variant which is offered in adult flavours like coffee in addition to menthol and full flavour. The consumer response to this offering has been encouraging. The rechargeable variant, EON Charge, further strengthened its performance during the year 17-18. Given the nascent state of the market and the evolving regulatory oversight globally, the Company remains engaged with the policy makers for adoption of an appropriate and equitable regulatory framework in India for this category.

Q22. Please provide an update on the Company's Hotels business.

Answer: The Hotels Business has recorded a healthy growth in Segment Revenue and profit driven by higher room rates, strong Food & Beverage sales and high operating leverage. The Business commissioned ITC Kohenur, a 271 room luxury property at Hyderabad, on 1st June 2018. The property has received excellent response from discerning guests, raising the bar of service excellence.

In view of the long-term potential of the Indian hospitality sector, the Company remains committed to enhancing the scale of the Business by adopting an 'asset-right' strategy that envisages building world-class tourism assets for the nation and growing the footprint of managed properties by leveraging its hotel management expertise. The Business made steady progress during the quarter in the construction of ITC Hotels at Kolkata & Ahmedabad and WelcomHotels in Guntur & Bhubaneswar. In addition, the Company's wholly-owned subsidiary in Sri Lanka made steady progress towards setting up a luxury hotel christened 'ITC One' and a super-premium residential apartment complex, 'Sapphire Residences - Colombo 1', situated at a strategic location in Colombo.

As reported earlier, the Company was declared the successful bidder for a 250-room luxury beach resort located in South Goa operating under the name Park Hyatt Goa Resort and Spa, following an auction held by IFCI Limited in February 2015 in terms of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002. Subsequent to making full payment of the bid amount, IFCI issued the requisite Sale Certificates in favour of the Company on 25th February, 2015. However, based on an appeal by the erstwhile owners, the sale had been struck down by the Honourable Bombay High Court. The Company and IFCI had contested the said order before the Honourable Supreme Court. On 19th March, 2018, the Honourable Supreme Court upheld the sale of the property by IFCI Limited to the Company and directed that the hotel property be handed over within six months. Accordingly, the property is expected to be handed over in the coming months.

Please refer to the Hotels section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2018 and Media Releases on quarterly results for further details.

Q23. Please provide an update on the Company's Agri Business.

Answer: The Business leveraged market opportunities in Oilseeds, Rice, Spices and Coffee resulting in robust growth in revenue during the quarter. However, pressure on legal cigarette industry volumes, adverse quality and leaf cost escalation pertaining to Andhra 2017 crop, and lower export incentives weighed on Segment Results.

The deep rural linkages and agri-commodity sourcing expertise resident in the Agri Business, including value-addition through identity preservation, traceability and certification are a critical source of competitive advantage for the Company.

The Business continues to leverage its wide geographical sourcing network, multiple sourcing models and customised infrastructure towards meeting the growing requirements for Aashirvaad atta and deliver substantial savings to the system through efficient logistics management and other cost-optimisation initiatives. Similarly, the Business sources high quality fruit pulp for B Natural through its extensive sourcing network and associated infrastructure in key growing areas in the country, while also enabling migration of entire B Natural juices portfolio to 'Not From Concentrate' fruit pulp sourced from Indian farmers.

The Business continues to step up initiatives in the area of value added agriculture to create new vectors of growth by leveraging its agri-commodity sourcing and processing expertise and the strong distribution network of the Company. These include the launch of packaged prawns, super safe spices, fresh fruits and vegetables and dehydrated onions under the ITC MasterChef and Farmland brands. Plans are afoot to rapidly scale up these interventions in the ensuing months.

Please refer to the Agri Business section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2018 and Media Releases on quarterly results for further details.

Q24. Please provide an update on the Company's Paperboards, Paper and Packaging Segment.

Answer: Segment Results registered robust growth driven by strategic investments in imported pulp substitution, process innovation leading to improved pulp yield, benefits of a cost-competitive fibre chain, product mix enrichment and higher realisation. While there was some improvement in the order book position during the quarter, Segment Revenue remained muted due to slow pick-up in demand in end user industries and unabsorbed capacity in the domestic industry. Shutdown of a paperboard machine for a part of the quarter for rebuild also weighed on Segment Revenue.

Operations of the Bleached Chemical Thermo Mechanical Pulp mill was scaled up during the quarter thereby reducing import dependency and delivering substantial savings to the Business, especially in view of the sharp increase in imported pulp prices in recent months.

Capacity utilisation was also scaled up at the recently commissioned Décor machine at the Tribeni unit. Rebuild of a paperboard machine at the Bhadrachalam unit is nearing completion and is likely to be commissioned in the ensuing quarter.

Please refer to the Paperboards, Paper & Packaging section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2018 and Media Releases on quarterly results for further details.

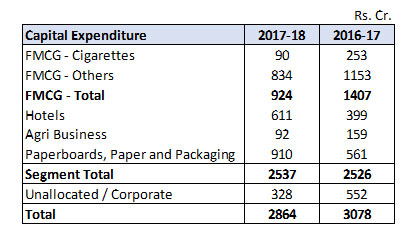

Q25. Please provide details of the Company's Capital expenditure by Business.

Answer: The Company's Capex during the last two financial years is tabulated below:

Q26. Please provide an overview of the capex plan of the Company.

Answer: The Company's capex plans are directed primarily towards capacity gearing, productivity enhancement, ensuring the highest standards in quality and environment, health & safety, and R&D.

One of the key elements of the capex plan going forward is to invest in setting up state-of-the-art owned integrated consumer goods manufacturing and logistics facilities across regions in line with long-term demand forecasts. Currently, over 15 projects are underway and in various stages of development - from land acquisition/site development to construction of buildings and other infrastructure.

In the Hotels Business, the construction of new hotels in Kolkata and Ahmedabad is progressing well. Besides, WelcomHotels Lanka Private Ltd. - a wholly-owned subsidiary of the Company is in the process of setting up a luxury hotel christened 'ITC One' and a super-premium residential apartment complex, 'Sapphire Residences - Colombo 1' at a strategic location in Colombo.

The major items of capital expenditure in the Paperboards, Paper and Packaging segment going forward comprise paperboards capacity augmentation/machine rebuild at the Bhadrachalam unit and capacity augmentation in Cartons and Flexibles packaging at the Tiruvottiyur and Haridwar unit.

Overall, the Company estimates capex of around 19000 Crores over the next 5 years (excluding investments for inorganic growth and acquisition of trademarks, other intellectual property, etc.). However, this would depend on several factors such as pick-up in economic activity and improvement in demand conditions, timely acquisition of land at desirable locations, obtaining approvals from the concerned authorities in a timely manner etc.

Q27. Why has the Segment Capital Employed increased by Rs. 1165 Crores from Rs. 22508 Crores as at 31st March 2018 to Rs. 23673 Crores as at 30th June 2018?

Answer: The increase in Segment Capital Employed was primarily on account of higher Net Fixed Assets (net of depreciation) towards capacity augmentation in FMCG businesses, ongoing investments in Hotels besides routine changes in working capital.

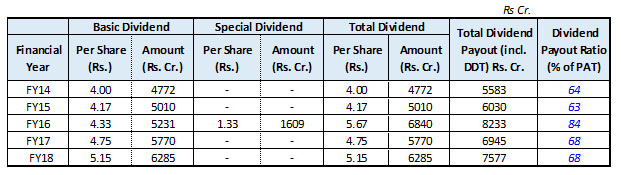

Q28. What are the dividend payout trends in recent years? What is the Dividend policy of the Company?

Answer: Dividend paid out by the Company for the last 5 years is given below:

Please refer to the following link for the Dividend Distribution policy of the Company.

http://www.itcportal.com/about-itc/policies/dividend-distribution-policy.pdf

Q29. Please explain the Company's 'Triple Bottom Line' philosophy.

Answer: Inspired by the opportunity to sub-serve larger national priorities, the Company redefined its Vision to not only reposition the organisation for extreme competitiveness but also make societal value creation the bedrock of its corporate strategy. This super-ordinate Vision spurred innovative strategies to address some of the most challenging societal issues including widespread poverty, unemployment and environmental degradation. The Company's sustainability strategy aims at creating significant value for the nation through superior 'Triple Bottom Line' performance that builds and enriches the country's economic, environmental and social capital. The sustainability strategy is premised on the belief that the transformational capacity of business can be very effectively leveraged to create significant societal value through a spirit of innovation and enterprise.

The Company is today a global exemplar in sustainability. It is a matter of immense satisfaction that its models of sustainable development have led to the creation of sustainable livelihoods for around six million people, many of whom belong to the marginalised sections of society. The Company has also sustained its position of being the only Company in the world of comparable dimensions to have achieved the global environmental distinction of being water positive (for 16 years in a row), carbon positive (for 13 consecutive years) and solid waste recycling positive (for 11 years in succession).

To contribute to the nation's efforts in combating climate change, the Company's strategy of adopting a low-carbon growth path is manifest in its growing renewable energy portfolio, establishment of green buildings, large-scale afforestation programme and achievement of international benchmarks in energy and water consumption. In FY 17-18, over 43% of the Company's total energy requirements were met from renewable energy sources - a creditable performance given its expanding manufacturing base. In addition, the practice of ensuring that premium luxury hotels, office complexes and factories of the Company are certified at the highest level by the US Green Building Council / Indian Green Building Council and the Bureau of Energy Efficiency (BEE) continues.

The Company has adopted a comprehensive set of sustainability policies that are being implemented across the organisation in pursuit of its 'Triple Bottom Line' agenda. These policies are aimed at strengthening the mechanisms of engagement with key stakeholders, identification of material sustainability issues and progressively monitoring and mitigating the impacts along the value chain of each Business.

The Company's 15th Sustainability Report, published during the year detailed the progress made across all dimensions of the 'Triple Bottom Line' for the year 2017-18. This report is in conformance with the latest Global Reporting Initiative (GRI) Guidelines - G4 under "In Accordance - Comprehensive" category and is third-party assured at the highest criteria of "reasonable assurance" as per International Standard on Assurance Engagements (ISAE) 3000.

Please refer to the following link http://www.itcportal.com/sustainability/sustainability-report-2018/sustainability-report-2018.pdf for Sustainability Report 2018.

In addition, the Business Responsibility Report (BRR), annexed to the Report and Accounts 2018, maps the sustainability performance of the Company against the reporting framework suggested by Securities and Exchange Board of India.

Q30. Please provide an update of the Company's Corporate Social Responsibility Programme.

Answer: The Company's Social Investments Programme aims to address the challenges arising out of poverty, environmental degradation and climate change through a range of activities with the overarching objective of creating sustainable sources of livelihood for stakeholders.

The footprint of the Company's CSR programme can be viewed at a glance in the following chart:

| Intervention Areas | Unit of Measurement | Cumulative till date |

| Social and Farm Forestry Soil and Moisture Conservation Programme | Lakh Acres Lakh Acres | 6.88 9.33 |

| Sustainable Agricultural Practices Compost Units | Number | 37,592 |

| Sustainable Livelihoods Initiative Cattle Development Centres Animal Husbandry Services | Number Artificial Inseminations (in lakhs) | 165 22.42 |

| Economic Empowerment of Women Ultra Poor Women covered Self Help Group Members Livelihoods created | Number Number Number | 20,100 38,127 61,166 |

| Primary Education Children covered | Number (in lakhs) | 5.72 |

| Health and Sanitation Low Cost Sanitary Units Households covered under Solid Waste Management | Number Number | 32,055 100,427 |

| Vocational Training Students Enrolled | Number | 57,810 |