Q1. What is ITC's Vision and Mission?

Answer:

Vision:

Sustain ITC's position as one of India's most valuable and admired corporations through world-class performance, creating growing value for the Indian economy and the Company's stakeholders.

Mission:

To enhance the wealth generating capability of the enterprise in a globalising environment, delivering superior and sustainable stakeholder value.

Q2. How does the Company effectively manage a highly diversified business portfolio? What is the Company's Corporate Governance structure?

Answer: ITC's 'Strategy of Organisation' is crafted in a manner that enables focus on each business while harnessing the diversity of the portfolio to create unique sources of competitive advantage. Please refer to the following link http://www.itcportal.com/about-itc/values/corporate-governance-structure.aspx for details of ITC's Governance Structure.

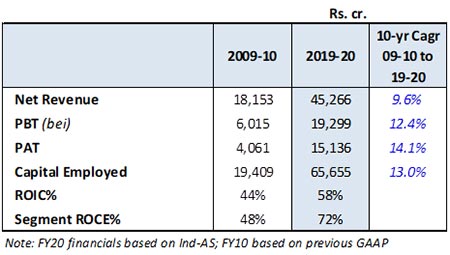

Q3. What is the Company's shareholder value creation track record?

Answer: ITC has been a consistent performer in terms of shareholder value creation. During the period 2009-10 to 2019-20, Total Shareholder Returns have clocked compound annual growth rate of ~11% significantly outperforming the Sensex which grew at 6.9% (based on market price as on 30th June 2020).

Q4. Please provide a brief overview of Q1 FY21 results.

Answer: Unprecedented disruptions in economic activity caused by nationwide lockdowns in the wake of COVID-19 pandemic weighed on the Company's performance during the quarter. Gross Revenue stood at Rs.9435.61 crores representing a decline of 17% - Hotels, Cigarettes, ESPB and Paperboards & Packaging Businesses were impacted the most. FMCG-Others Segment delivered a strong performance driven by Staples, Convenience Foods and Health & Hygiene products, leveraging the strong equity of the Company's brands and a robust portfolio of relevant and innovative products. Negative operating leverage and adverse business mix weighed on profits which was partially mitigated through extreme focus on cost reduction. Profit After Tax and Total Comprehensive income stood at Rs. 2342.76 crores (previous year Rs.3173.94 crores) and Rs.2337.03 crores (previous year Rs. 2960.93 crores) respectively. Earnings Per Share for the quarter was Rs. 1.91 (previous year Rs. 2.59).

Other than the Hotels segment, progressive normalisation was witnessed in the later part of the first quarter across all operating segments. The recent imposition of localized lockdowns in several parts of the country, however, are posing operational challenges and impacting the recovery momentum. The Company shall continue to closely monitor the situation and respond with agility to strengthen its market standing while sharply focusing on cost reduction measures.

Q5. Please provide a revenue split of the FMCG–Others Segment.

Answer: The Branded Packaged Foods Businesses represent the largest component of this segment, accounting for ~77% of Segment Revenue. The Personal Care Business and Education and Stationery Products Business cumulatively account for ~16% of Segment Revenue.

Q6. What are the new FMCG categories that the Company is likely to enter over the short to medium term?

Answer: With aspirations to become the No.1 FMCG player in India, the Company continuously evaluates opportunities to grow in the FMCG space.

The Company is uniquely positioned to leverage its significant investments in product development, R&D and innovation to effectively address these emerging need spaces. The agility demonstrated during the lockdown phase including expeditious ramp up of operations and enhancement of capacity, launch of new products such as Savlon disinfectant spray in record time, deployment of ITC Store-on-Wheels and ITC e-Store, collaboration with third parties for last mile delivery to cater to surge in consumer demand, bears testimony to the Company's resilience and capabilities.

The Company seeks to significantly scale up the FMCG Businesses leveraging its institutional strengths viz. deep consumer insight, proven brand building capability, agri-commodity sourcing expertise, cuisine knowledge, strong rural linkages, a deep and wide channel-tailored distribution network and packaging know-how. In addition, the Company continues to make significant investments in R&D, strengthen supply chain capability, focus on consumer insight discovery and harness digital technology to develop and launch disruptive and breakthrough products in the market place. With these interventions, the Company is well poised to strengthen its market standing and seize growth opportunities in the FMCG space in the new normal.

Q7. (a) Please update on the margin profile of the FMCG - Others Segment.

Answer: The Segment EBITDA margins of the FMCG-Others segment have been on an upward trajectory over the last 12 quarters and have moved up from ~2.6% in Q1 FY18 to ~8% in FY20. Segment EBITDA for Q1 FY21 grew by 42.4% to Rs. 257 crores, with Segment EBITDA margins expanding by 170 bps y-o-y, driven by enhanced scale, product mix enrichment and strategic cost management initiatives, notwithstanding increase in input costs, sustained investments in brand building, gestation costs of new categories, start-up costs of new facilities and incremental cost due to outbreak of COVID-19 pandemic. The expansion in EBITDA margins is attributable inter alia to strategic interventions such as focus on premiumisation of the portfolio, setting up of Integrated Consumer goods Manufacturing and Logistics (ICMLs) facilities closer to demand centres and operational efficiencies due to scaling up in the growth segments, etc.

(b) What is the margin profile of the Branded Packaged Foods Business?

Answer: The Branded Packaged Foods Businesses of the Company comprise 'Staples & Meals', 'Snacks', 'Dairy & Beverages', 'Biscuits & Cakes' and 'Chocolates, Coffee & Confectionery'. These Businesses have evolved over a period of time and are currently at different stages of their lifecycles. As such, the revenue dimensions, cost structures and profitability profiles of each of these businesses are distinct from the other. For example, EBIT margin for the Staples business, which is a relatively mature category, is in the high single digit range while for the Snack Foods the same is in the mid-single digit range representing upfront investments towards category development and brand building. Overall, each category is striving towards achieving best-in-class margins within a reasonable period of time.

(c) What is the margin profile of the Personal Care Products Business?

Answer: The Personal Care Products Business presently comprise 'Personal Wash & Hygiene', 'Fragrances', 'Home Care', 'Skin Care', 'Health' and 'Talc' categories. The Company continues to make significant investments in this Business primarily in the area of brand building, R&D and product development towards competing effectively with incumbent players comprising firmly entrenched MNCs and domestic companies.

Presently, each category is operating at industry benchmarked gross margins. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins progressively over the medium-term.

Q8. Would ITC contemplate acquisitions in order to achieve its vision in the Other FMCG segment?

Answer: In recent times, Company has acquired Brands such as 'Savlon', 'Nimyle' and 'Charmis' to strengthen its presence in Personal Care Products segment.

Heightened awareness for personal hygiene in the wake of the COVID-19 pandemic led to a surge in demand for products in the 'Health and Hygiene' portfolio such as hand sanitizers, handwash and antiseptic liquids. Demonstrating a high degree of agility and responsiveness to the market dynamics at play, the Business rapidly expanded manufacturing capacity manifold and enhanced availability of the 'Savlon' antiseptic liquid, soap, handwash and hand sanitizer in the market.

The Business also continued to expand its presence in the Floor Cleaner category leveraging the 'Nimyle' brand. During the year, Nimyle witnessed strong growth in the East and also expanded its geographical footprint to the South, to become the 3rd largest brand nationally in a relatively short span of time. The brand's natural action proposition offers immense potential to build on the values of authenticity and trust which have assumed critical significance in the wake of COVID-19 pandemic.

ITC examines prospects for inorganic growth that arise from time to time not only in this business segment but also in the other businesses, guided by considerations such as strategic fit, valuation, financial viability, ease of integration etc.

It is pertinent to note that in July'20, the Company has acquired 100% of the equity share capital of Messrs. Sunrise Foods Private Limited (SFPL), an Indian company primarily engaged in the business of spices under the trademark 'Sunrise', and two of its subsidiaries Messrs. Sunrise Sheetgrah Private Limited and Messrs. Hobbits International Foods Private Limited.

The acquisition will augment the Company's product portfolio and will also align with the Company's aspiration to significantly scale up its Spices business and expand its footprint across the country. The deep consumer connect and distribution strength of SFPL in the focus markets, together with synergies arising out of the sourcing and supply chain capabilities of the Company's Agri Business and its pan-India distribution network, will provide significant value creation opportunities for the Company.

Q9. Please provide an update on the Company's progress in the FMCG-Others Segment during the quarter.

Answer: The onset of COVID-19 pandemic and the consequent lockdowns to curb its spread caused severe disruption in manufacturing, supply chain, and sales & distribution operations. Amidst such challenging circumstances, the Company was amongst the fastest off the blocks to resume operations after obtaining necessary permissions in the lockdown phase, with safety and employee well-being accorded paramount importance.

Segment Revenue grew 12.2% on a comparable basis (excl. Lifestyle Retailing). Excluding the Education and Stationery Products Business, which was impacted by the closure of educational institutions in the wake of the pandemic, Segment Revenue grew by 18.8%. Segment EBITDA grew by 42% to 257 cr., with margins expanding by 170 bps y-o-y, notwithstanding the gestation costs of new categories/facilities and the incremental operating costs due to the COVID-19 pandemic.

Following the outbreak of the pandemic, there is heightened awareness of quality products anchored on vectors of health, wellness and immunity. There is a rising trend of 'at-home' as opposed to 'out-of-home' consumption. Apart from a thrift mindset, consumers are also preferring larger pack formats as they seek to reduce frequency of purchase. Heightened concerns on hygiene and safety are also manifesting in consumers' preference for trusted brands. Consequently, staples, noodles, biscuits, dairy, sanitizers, hand wash, floor cleaners, etc. witnessed robust demand. On the other hand, discretionary categories and those with relatively higher salience of 'out-of-home' consumption witnessed contraction. The Businesses significantly ramped up capacity in certain categories as heightened concerns on health & hygiene and uncertainty on the duration of lockdowns led to a surge in demand.

The Branded Packaged Foods Businesses delivered a robust performance during the quarter driven by Atta, Noodles, Biscuits and Fresh Dairy. Most major categories gained market share during the quarter.

- In the Staples, Snacks and Meals category, 'Aashirvaad' atta posted strong growth across markets. The brand further fortified its leadership position in the branded packaged atta industry during the quarter with significant value and volume growth. 'Yippee!' Noodles posted substantial growth driven by increased 'at-home' consumption and leveraging high-decibel brand campaigns. The 'Bingo!' Snacks category, which saw subdued operational performance during the initial phase of the lockdown due to restricted mobility, rapidly normalised after the restrictions of complete lockdown were lifted.

- 'Sunfeast' Biscuits and Cakes recorded robust growth driven mainly by surge in 'at home' consumption and the consumers' preference for trusted brands. Veda Marie, launched last year, continued to record impressive growth in all target markets.

- In the Dairy & Beverages category, 'Aashirvaad Svasti' range of fresh dairy products and ghee recorded strong growth. The range of milk products was augmented with the launch of Aashirvaad Svasti Lassi, which has received encouraging consumer response. The 'B Natural' range of juices anchored on the 'goodness of fibre' proposition was augmented with the launch of two innovative variants addressing immunity needs in partnership with Amway. The immunity range has met with encouraging response from discerning consumers.

- The Chocolates and Confectionery categories were severely impacted reflecting the subdued demand for discretionary products; these categories are witnessing progressive normalisation as the lockdowns are being eased across the country.

The Personal Care Products Business recorded substantial growth in revenue driven by heightened awareness and demand for hygiene products such as hand sanitizers, handwash, antiseptic liquids and floor cleaners in the wake of COVID-19 pandemic. However, the 'Engage' range of fragrancing products witnessed a tepid quarter due to significant decline in demand.

Demonstrating a high degree of agility and responsiveness to the market dynamics at play, the Business rapidly expanded manufacturing capacity manifold and enhanced availability of 'Savlon' antiseptic liquid, soap, handwash, hand sanitizer and 'Fiama' handwash products in the market. The newly set-up perfume manufacturing plant at Manpura, Himachal Pradesh was re-purposed in quick time to manufacture hand sanitizers and service increased demand. Savlon, which has gained repute over the years for effectiveness in protection against germs, grew manifold driven by significant surge in demand, backed by innovative products and rapid scale-up in capacity. The portfolio was augmented with the launch of several innovative products in record time viz., 'Savlon Surface Disinfectant Spray', 'Savlon Hexa' hand sanitizing liquid, 'Savlon Germ Protection Wipes', Savlon Hand Sanitizer Sachet, 'Savlon Hexa advanced' Soap. These products have received excellent consumer response and are being scaled up across markets. The formulations of all the new products launched during the quarter have been developed in-house at the Company's state-of-the-art Life Sciences and Technology Centre. During the quarter, one of the brand's signature campaigns, Savlon Healthy Hands Chalk Sticks, featured in the Cannes Lions 'iconic work' of the decade.

The Business continued to expand its presence in the Floor Cleaner category leveraging the 'Nimyle' brand gaining market leadership in Odisha, while further strengthening its market standing in West Bengal. Nimyle also posted appreciable growth in the South. The Hygiene portfolio was augmented with the launch of 'Nimwash' - Vegetables & Fruit Wash Liquid – a 100% natural action solution made with Neem & Citrus extracts that assures the effective removal of pesticides and 99.9% germs from fruits & vegetables. The product has received encouraging response and is being scaled up.

The Businesses continue to leverage state-of-the-art integrated consumer goods manufacturing facilities (ICMLs) to service proximal markets in a highly efficient and responsive manner.

As stated earlier, ESPB was severely impacted during the quarter due to deferment of new academic sessions and closure of educational institutions across the country. Proactive interventions such as online order taking, Direct-to-Consumer delivery in select cities, alternative hyperlocal delivery models, ramping up availability through e-Com channels etc. are being pursued to mitigate the impact. The scenario in the short-term remains challenging with uncertainty around resumption timelines of academic sessions across various states. Notwithstanding this uncertainty, the Company, with its strong brands, superior quality and environment-friendly paper, robust product portfolio, collaborative linkages with small & medium enterprises and superior distribution is well poised to strengthen its leadership position in the industry.

The Agarbatti industry was confronted with significant operational challenges, especially in the initial lockdown phase, mainly due to higher focus of consumers and trade channels on essential products. Proactive steps taken by the Business have enabled it to stage a smart recovery in the month of June'20. The Business continues to focus on scaling up the availability of recently launched innovative products, sustaining product superiority and enhancing supply chain efficiency to drive growth across all key segments.

With effect from 1st April, 2020, GST rates for all safety matches irrespective of process of manufacture (mechanised/semi-mechanised units and 'handmade' safety matches) have been harmonised at 12% compared to 18% for mechanised/semi-mechanised and 5% for handmade matches earlier, thereby levelling the playing field. Despite supply chain disruptions due to the pandemic, the Business was able to quickly ramp up availability across markets and consolidate its market standing on the back of narrowing of the price gap of its products compared to competitors as a result of uniformity in GST rates.

The Company responded with agility, speed and resilience, together with a structured process of proactive planning, to operate in the 'new normal'. The Company fast tracked the design, development and go-to-market strategy of new products and launched twelve innovative and relevant products in record time to meet the increasing demand for safety, immunity and hygiene products.

The significant surge in demand across categories in the portfolio was met through technology enabled solutions leveraging predictive analytics tools, shortened demand planning cycles, focus on fewer SKUs and higher-value packs, backed by flexible manufacturing plans and responsive supply chain operations to cater to variability in demand. During the lockdown phase, nearly two-thirds of the throughput was delivered direct to customer/market from factories leading to reduction in time-to-market, which was a key consumer need given the anxiety around the COVID-19 pandemic.

A series of concerted actions were taken to realign the distribution infrastructure so as to respond to the multiple challenges arising out of restricted mobility of people and goods, curbs on working hours and outlet operations. Several technology-driven solutions were deployed to effectively service the surge in demand. The Company was the first in the industry to launch an online ordering system for retailers. The Company also facilitated swift scaling up of tele-calling and Whatsapp based order taking from retailers and deployed mechanised and non-mechanised delivery modes. The Company also pioneered an innovative model - ITC Store on Wheels - to directly service consumers in residential complexes (catered to 800+ unique residential societies in top markets). The exclusive 'ITC e-store', launched just prior to the implementation of the lockdown, facilitated on-demand direct deliveries to consumers. The Company also enhanced the presence of its product portfolio in alternative channels and entered into collaboration with several companies such as Dominos, Swiggy, Zomato, Dunzo to efficiently service consumers.

The Company expanded its presence in the emerging channels of Modern Trade and e-Commerce during the quarter, growing at over 20% and 90% respectively. In the Modern Trade channel, the Company carried out direct store deliveries, significantly reducing the time to market. It also scaled up presence on popular e-Commerce platforms on the back of preference for contactless shopping and home delivery. Sales in rural markets grew rapidly leveraging the stockist channel.

The Branded Packaged Foods, Personal Care Products and the Agarbatti Businesses sustained their focus on deepening consumer engagement through refreshed and high decibel campaigns in conventional and social media platforms, with contextual communication to enhance discoverability and stay relevant to consumers in challenging times. The Company leveraged its marketing command centre - 'Sixth Sense'- to deepen engagement with consumers through 'moment marketing' campaigns on social media platforms.

The Company's employees, trade partners, transporters and their associates were provided extensive training – both online and at the place of work - in social distancing and personal protection. Standard Operating Processes (SOPs) were developed and implemented to ensure safe and hygienic work conditions both at the work place as well as in the market. The Company facilitated the process of obtaining insurance against COVID-19 for associates of trade partners and also rendered financial assistance in this regard, thereby forging stronger ties with them.

Please refer to the FMCG - Others section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2020 and Media Releases on quarterly results for further details.

Q10. Please provide an update on the Cigarettes business. What is the Company's view on cigarette volume trends over the medium to long term?

Answer: Unprecedented disruption was witnessed across the value chain with manufacturing and selling & distribution operations being severely restricted following the imposition of lockdown. During the quarter, manufacturing operations were resumed in mid-May and thereafter rapidly scaled up. Currently all factories are operational and production has been scaled up to pre-COVID levels. The sales & distribution operations have largely normalised. However, re-imposition of localized lockdowns towards the end of June'20 and in recent weeks in certain parts of the country have caused closure of outlets and restrictions in operations in the containment zones, posing operational challenges.

The Company took focused actions during the quarter to consolidate its market standing. Deep consumer insights and a robust innovation pipeline enabled the Business to introduce new variants catering to the continuously evolving consumer preferences. Gold Flake Luxury filter in the Longs segment, and Navy Cut Deluxe Filter, Gold Flake Indie Mint and Capstan Fresh in the regular size filter segment, were extended to target markets. The Business also introduced Gold Flake Super Star (Supermint), Gold Flake Star and Royal in the DSFT segment in competitive markets straddling key price points. The Flake brand was launched in an innovative 5s pack in target markets. During the quarter, the Company leveraged its extensive footprint to quickly scale up availability through the grocery channel while the stockist network was augmented to service rural/semi-urban markets in an efficient manner.

Discriminatory taxation on cigarettes, has caused progressive migration from consumption of duty-paid cigarettes to other lightly taxed/tax-evaded forms of tobacco products, comprising illegal cigarettes and bidi, chewing tobacco, Gutkha, Zarda, snuff, etc. Rapid growth in illicit cigarette volumes has resulted in sub-optimisation of the revenue potential of the tobacco sector and significant loss to the Exchequer. It is estimated that on account of illegal cigarettes alone, the revenue loss to the Government is almost Rs. 15000 crores per annum. While the share of legal cigarettes in total tobacco consumption in the country has declined considerably from 21% in 1981-82 to a mere 9% (against global average of 90%), aggregate tobacco consumption has increased over the same period. The stability in taxation between the sharp increase in July'17 under GST till the period up to January'20, provided some relief to the legal cigarette industry and lent buoyancy to tax collections. However, this period of relative stability in taxes was halted with the sharp increase of 13% in tax incidence as a result of a significant hike in National Calamity Contingency Duty in February'20, thus providing a further fillip to this large and rapidly growing illicit cigarette trade in the country. In fact, it is a matter of grave concern that while legal cigarettes trade was severely impacted, smuggled cigarettes continued to be widely available, despite the deterrent actions taken by the authorities to curb the menace.

The inadvertent and unforeseen consequence of the stringent Indian tobacco regulations and discriminatory taxation continues to adversely impact the livelihood of Indian tobacco farmers with corresponding gains to tobacco farmers in the countries that have opted for moderate and equitable tobacco regulations.

Notwithstanding the challenges as enumerated above, the Company remains confident of fortifying its market standing in the legal cigarette industry by leveraging its superior strategies, execution excellence, investments in cutting-edge technology and a future ready product portfolio. Being the market leader, the Company is well placed to capture all opportunities and emerge stronger with the continuing support of consumers.

Please refer to the FMCG - Cigarettes section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2020 and Media Releases on quarterly results for further details.

Q11. Please provide an update on the Company's Hotels business during the quarter.

Answer: The outbreak of COVID-19 pandemic in the last quarter of FY20 continues to weigh heavily on the Hotels Business. Operations during the quarter came to a standstill with operations limited mainly to service stranded guests and wherever required, as quarantine facilities. With severe restrictions on travel and heightened sensitivity around hygiene and social distancing, revenue streams across all segments of operations have been significantly impacted. Negative operating leverage weighed on segment profits, while aggressive reduction in controllable fixed costs partly mitigated the impact.

The Business resumed operations in accordance with the prescribed guidelines, from the second week of June'20, with a refreshed and revamped service design. To reassure guests at the Company's iconic Hotels and to provide best in class experience in hygiene and safety, the "WeAssure" programme has been launched. This programme has been designed in collaboration with medical professionals and disinfection experts. The programme further enhances the existing hygiene and cleaning protocols across all hotels. The Business is also progressing towards an accreditation by National Accreditation Board for Hospitals & Healthcare Providers (NABH) for its procedures, and is working on assurance of higher levels of hotel operating standards by DNV GL Business Assurance by building on the pillars of health, hygiene, safety and pathogen control.

Several interventions have also been implemented by the Business to mitigate the impact of the challenging business environment and help bounce back stronger. These include customised packages for short getaways/staycations, revamped packages with curated offers for the MICE (meetings, incentives, conferencing, exhibitions) segment, extension of additional benefits to members of the Club ITC loyalty programme, launch of 'Lavenderia' - premium in-house Dry Cleaning & Laundry Service in select cities, enhanced guest connect through sharing of contextual content in social media etc.

For presenting unique cuisine experiences to discerning guests during the lockdown, ITC Hotels launched 'Flavours' and 'Gourmet Couch' menus as home delivery and takeaway offerings. The Gourmet Couch menu consists of a medley of the finest cuisines from the signature restaurants at ITC Hotels with its iconic dishes like Dal Bukhara, Dum Pukht Biryani, Barrah Kebab, etc. Crafted with care by ITC Hotels and handled with utmost attention to hygiene, the mindfully created menus bring unique food experiences for diners across all major cities in India. The Business also partnered with food delivery platforms 'Zomato' and 'Swiggy' to enable wider availability of the offering. The initiative has been widely welcomed by the target customers.

The Hotels and Foods Businesses together curated a first-of-its-kind cooking show, '5 STAR Kitchen ITC Chef's Special'. The 12-episode series, featuring delectable creations of 12 ITC masterchefs using the Company's food brands, was aired on the STAR TV Network across 33 channels in 7 languages and Hotstar, reaching an audience of 157 million. The content was also dubbed in 7 regional languages.

While there are significant near-term challenges on account of the outbreak of the COVID-19 pandemic, the sector continues to hold immense potential in view of the robust long-term economic and tourism prospects of the country. With its portfolio of world-class properties, iconic cuisine brands and best-in-class levels of service excellence anchored on 'Responsible Luxury' ethos and the highest standards of hygiene at all touchpoints, the Company is well-positioned to sustain its pre-eminent position in the Indian Hospitality industry and to successfully overcome these challenges.

Please refer to the Hotels section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2020 and Media Releases on quarterly results for further details.

Q12. Please provide an update on the Company's Agri Business during the quarter.

Answer: The Agri Business recorded a growth of 3.7% in Segment Revenue driven by trading opportunities mainly in oilseeds and rice.

The Business continued to leverage its strong farm linkages and wide sourcing network across geographies to secure supplies of critical grades of wheat with benchmark quality towards meeting the growing requirements of Aashirvaad atta. Despite the supply chain disruptions caused by the COVID-19 pandemic, the Business pro-actively engaged with Centre and State authorities to secure permissions expeditiously to commence sourcing operations. The Business leveraged deep farmer connect built through over two decades of the e-Choupal network, to scale up direct farm purchases. Together with the multi-modal procurement & supply chain model (covering network of transporters operating on road, rail and coastal routes), the Business was able to ramp up the volume of wheat procurement substantially to cater to the surge in demand for Aashirvaad atta.

During the quarter, the Business also ramped up the direct milk sourcing network in West Bengal to cater to the increasing requirements on the back of the growing franchise of the Aashirvaad Svasti range of dairy products.

The 'ITC Master Chef' range of Frozen Snacks posted robust growth in the retail channel. The range of Frozen Snacks was augmented with the launch of eight new exciting variants and the range was extended to 70+ cities during the quarter.

Subdued demand for leaf tobacco in international markets and adverse business mix weighed on Segment Results. Despite operational challenges, the leaf tobacco sub-segment ensured business continuity for key export customers by carrying out first level quality evaluation through internal teams leveraging knowledge of customer product standards, offered substitute grades to mitigate disruptions in supply from other origin and leveraged technology to facilitate remote inspections.

Please refer to the Agri Business section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2020 and Media Releases on quarterly results for further details.

Q13. Please provide an update on the Company's Paperboards, Paper and Packaging Segment during the quarter.

Answer: Segment revenue declined by 32.8% largely on account of the disruptions caused by the outbreak of the COVID-19 pandemic. Significant growth in exports partly mitigated the weak domestic demand environment.

While demand for paperboards and packaging from Pharma and FMCG end-user customer segments was relatively stable, relatively subdued offtake in certain segments (e.g. liquor, cupstock, tobacco, hosiery) and significant adverse impact in others (such as publications, décor, wedding cards etc.) impacted operational performance. The demand for writing and printing paper has also been impacted due to closure of educational institutions and offices in the wake of the pandemic. In the packaging sub-segment, flexibles packaging witnessed robust demand while cartons packaging, impacted by sluggish demand in the end-user segments as enumerated above, was subdued.

Swift resumption of business ahead of competition, strong dealer network and agility in servicing customer needs aided in further strengthening market share in the Value Added Paperboards segment. Proactive investments made by the Business over the years to make structural interventions in the areas of strategic cost management and import substitution continue to aid margin expansion and strengthen competitive advantage.

Please refer to the Paperboards, Paper & Packaging section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2020 and Media Releases on quarterly results for further details.Q14. Why has the Segment Capital Employed reduced by from Rs. 26,140 Crores as at 30th June 2019 to Rs. 24,723 Crores as at 30th June 2020?

Answer: The decrease in Segment Capital Employed is primarily on account of lower trade receivables due to lower throughput in first half of the quarter partly offset by higher inventory in Education and Stationery Products Business due to postponement of academic season.

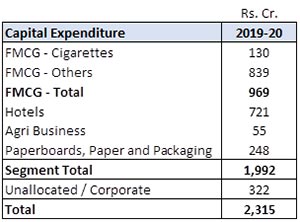

Q15. Please provide details of the Company's Capital expenditure by Business.

Answer: The Company's Capex during the last financial year is tabulated below:

Q16. Please provide an overview of the capex plan of the Company.

Answer: The Company's capex plans are directed primarily towards capacity gearing, productivity enhancement, ensuring the highest standards in quality and environment, health & safety, and R&D.

One of the key elements of the capex plan in recent years has been to invest in setting up state-of-the-art owned integrated consumer goods manufacturing and logistics facilities across regions in line with long-term demand forecasts. Over the years, the Company has invested in several state-of-the-art Integrated Consumer Goods Manufacturing and Logistics facilities (ICMLs) towards augmenting its manufacturing and sourcing footprint across categories with a view to providing structural advantages such as ensuring product freshness, improving market responsiveness, reducing the cost of servicing proximal markets and providing heightened focus on product hygiene, safety and quality. The ICMLs also enable scalability, besides setting new benchmarks in quality, safety, productivity and process excellence. During the year, the Business ramped up capacity utilisation at the recently commissioned facilities at Trichy, Guwahati, Panchla, Haridwar & Pune.

The Hotels Business made steady progress during the quarter in the construction of an ITC Hotel in Ahmedabad and Welcomhotels in Guntur & Bhubaneswar. Most of the planned investments in the current capex cycle will be completed with the commissioning of these hotels. As reported earlier, the Company's asset-right strategy envisages a large part of incremental room additions going forward to accrue through management contracts. This, along with enhanced focus on sweating existing assets and creating additional revenue streams are expected to reduce the capital intensity of the Business and, inter alia, improve financial return metrics.

The major items of capital expenditure in the Paperboards, Paper and Packaging segment going forward comprise paperboards capacity augmentation/machine rebuild at the Bhadrachalam unit and capacity augmentation in Cartons and Flexibles packaging at the Tiruvottiyur and Haridwar unit.

In the short term, the Company shall primarily focus on timely completion/operationalisation of on-going projects. Going forward, the spends would be appropriately stepped up depending on several factors such as pick-up in economic activity and improvement in demand conditions.

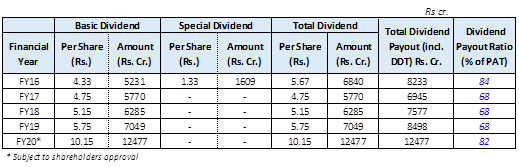

Q17. What is the Dividend policy of the Company? What is the dividend pay-out trends in recent years?

Answer: As per the Dividend Distribution policy approved by the Board of Directors on 18th March'20, effective financial year 2019-20, in the medium term, the dividend pay-out ratio is expected to be around 80% to 85% of the Profit After Tax of the Company. The Board may declare interim dividend(s) at its discretion. The Board's recommendation to the shareholders on the final dividend may include special dividend(s) as considered appropriate.

Dividend paid out by the Company for the last 5 years is given below:

Please refer to the following link for the Dividend Distribution policy of the Company.

http://www.itcportal.com/about-itc/policies/dividend-distribution-policy.pdf

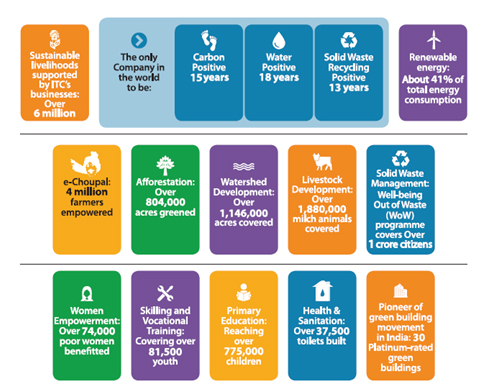

Q18. Please explain the Company's 'Triple Bottom Line' philosophy.

Answer: Inspired by the opportunity to sub-serve larger national priorities, the Company redefined its Vision to not only reposition the organisation for extreme competitiveness but also make societal value creation the bedrock of its corporate strategy. This super-ordinate Vision spurred innovative strategies to address some of the most challenging societal issues including widespread poverty, unemployment and environmental degradation. The Company's sustainability strategy aims at creating significant value for the nation through superior 'Triple Bottom Line' performance that builds and enriches the country's economic, environmental and social capital. The sustainability strategy is premised on the belief that the transformational capacity of business can be very effectively leveraged to create significant societal value through a spirit of innovation and enterprise.

ITC has been ranked #1 globally amongst peers (comprising companies with market capitalisation between USD 38 Bln. and USD 51 Bln.) and overall #3 globally on ESG performance in the Food Products industry by Sustainalytics - a renowned global ESG ratings company. ITC has been rated 'AA' by MSCI-ESG - the highest among global tobacco companies.

ITC is a global exemplar in sustainability, the key highlights of which are given below:

ITC has recently launched a first-of-its-kind model for sustainable management of Multi-Layered Plastic packaging waste in Pune in partnership with SWaCH, a leading waste-pickers cooperative and with active patronage and cooperation from the Pune Municipal Corporation. Leveraging the expertise resident in the ITC Life Sciences and Technology Centre, viable options have been found to convert multi layered plastic waste into useful items of consumption. Efforts are underway to scale up this initiative and replicate the model in other parts of the country.

To contribute to the nation's efforts in combating climate change, the Company's strategy of adopting a low-carbon growth path is manifest in its growing renewable energy portfolio, establishment of green buildings, large-scale afforestation programme and achievement of international benchmarks in energy and water consumption. In FY 18-19, about 41% of the Company's total energy requirements were met from renewable energy sources - a creditable performance given its expanding manufacturing base. The Company is well positioned to benefit from energy conservation and renewable energy promotion schemes such as Perform, Achieve and Trade (PAT) and Renewable Energy Certificates (RECs) promoted by the Government of India. As a responsible corporate citizen, the Company has made a commitment to reduce dependence on energy from fossil fuels. Accordingly, all factories incorporate appropriate green features and premium luxury hotels and office complexes continue to be certified at the highest level by either the US Green Building Council, Indian Green Building Council or the Bureau of Energy Efficiency (BEE).

The Company has adopted a comprehensive set of sustainability policies that are being implemented across the organisation in pursuit of its 'Triple Bottom Line' agenda. These policies are aimed at strengthening the mechanisms of engagement with key stakeholders, identification of material sustainability issues and progressively monitoring and mitigating the impacts along the value chain of each Business.

The Company's 16th Sustainability Report, published during the year detailed the progress made across all dimensions of the 'Triple Bottom Line' for the year 2018-19. This report is in conformance with the Global Reporting Initiative (GRI) standards under 'In Accordance – Comprehensive' category and is third-party assured at the highest criteria of 'reasonable assurance' as per International Standard on Assurance Engagements (ISAE) 3000. The 17th Sustainability Report, covering the sustainability performance of the Company for the year 2019-20, is being prepared in accordance with the GRI Standards and will be made available shortly.

Please refer to the following link

1. 16th Sustainability Report: https://www.itcportal.com/sustainability/sustainability-report-2019/sustainability-report-2019.pdf

2. ITC Sustainability at a glance: https://www.itcportal.mobi/itc-csr-brochure.pdf

In addition, the Business Responsibility Report (BRR), annexed to the Report and Accounts 2020, maps the sustainability performance of the Company against the reporting framework suggested by Securities and Exchange Board of India.

The Company has voluntarily prepared its Integrated Report for the financial year 2019-20. As a green initiative, the Report has been hosted on the Company's corporate website at https://www.itcportal.com/about-itc/shareholder-value/itc-integrated-report-2020.pdf

During the quarter, the Company had submitted a letter to SEBI and stock exchanges on its response to COVID-19. The link for the same is https://www.itcportal.com/about-sitc/shareholder-value/pdf/lodr26062020-d.pdf.