ITC has been ranked #1 globally amongst peers (comprising companies with market capitalisation between USD 38 Bln. and USD 51 Bln.) and overall #3 globally on ESG performance in the Food Products industry by Sustainalytics - a renowned global ESG ratings company.

Q2 FY20 Results Update and Frequently Asked Questions

Q1. What is ITC's Vision and Mission?

Answer:

Vision:

Sustain ITC's position as one of India's most valuable and admired corporations through world-class performance, creating growing value for the Indian economy and the Company's stakeholders.

Mission:

To enhance the wealth generating capability of the enterprise in a globalising environment, delivering superior and sustainable stakeholder value.

Q2. How does the Company effectively manage a highly diversified business portfolio? What is the Company's Corporate Governance structure?

Answer: ITC's 'Strategy of Organisation' is crafted in a manner that enables focus on each business while harnessing the diversity of the portfolio to create unique sources of competitive advantage. Please refer to the following link https://www.itcportal.com/about-itc/values/index.aspx#sectionb4 for details of ITC's Governance Structure.

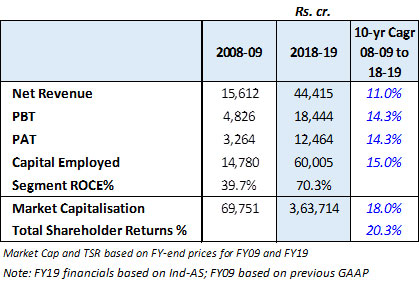

Q3. What is the Company's shareholder value creation track record?

Answer: ITC has been a consistent performer in terms of shareholder value creation. During the period 2008-09 to 2018-19, Total Shareholder Returns have clocked compound annual growth rate of 20.3% significantly outperforming the Sensex (14.8%).

Q4. Please provide a brief overview of Q2 FY20 results.

Answer: The Company posted a steady performance during the quarter amidst a particularly challenging operating environment. Gross Revenue for the quarter stood at Rs. 11750.16 crores, representing a growth of 6%, driven mainly by Paperboards, Hotels and FMCG-Others (excluding the Lifestyle Retailing Business). Profit after Tax at Rs. 4023.10 grew by 36.2%. Total Comprehensive Income stood at Rs. 3979.73 crores (previous year Rs. 2754.55 crores). Earnings Per Share for the quarter stood at Rs. 3.28. Operating cash flow before working capital changes for the half year aggregated Rs. 9274.77 crores (previous year Rs. 8606.81 crores). Increase in working capital during the period is largely attributable to strategic sourcing of agri commodities, based on assessment of market dynamics to service the growing requirements of the Branded Packaged Foods Businesses. Please refer answer to Question 5(e) below.

Q5. (a). Why has 'Consumption of Raw Material etc. (net)' gone up by 5% during Q2 FY20 as compared to Q2 FY19?

Answer: On a comparable basis, increase in Consumption of Raw Material etc. (net) is 5.2%, which is in line with the growth in Revenue.

Q5. (b). The 'Other Expenditure' in Q2 FY20 has remained flattish at Rs. 2195.12 Crores as compared to same period last year. Please explain

Answer: On a comparable basis, increase in Other Expenditure is ~5% which is mainly attributable to enhanced scale of operations, higher spends on Advertisement and Trade Developments activities.

Q5. (c). What is the growth in FMCG - Others - Segment EBITDA in Q2 FY20 as compared to Q2 FY19?

Answer: In respect of FMCG-Others segment, Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA), for Q2 FY20 is at ~Rs. 221 Crores representing a growth of 39% despite stepped up investments in brand building, gestation and start-up cost of new categories/new facilities.

Q5. (d). What is the impact on EBITDA and PBT due to adoption of IND AS 116?

Answer: The Company has adopted Ind AS 116 "Leases" effective 1st April 2019, as notified by the Ministry of Corporate Affairs (MCA) vide Companies (Indian Accounting Standard), Amendment Rules, 2019, using the modified retrospective method. The adoption of this Standard did not have any material impact on the profit for the quarter ended 30th June 2019.

Q5. (e). What is the impact, if any, arising out of the amendments to the Income Tax Act, 1961 as introduced by the Taxation Laws (Amendment) Ordinance, 2019?

Answer: The Company has exercised the option permitted under Section 115BAA of the Income-tax Act, 1961 as introduced by the Taxation Laws (Amendment) Ordinance, 2019. Accordingly, the Deferred Tax Liabilities (net) as at 31st March, 2019 (arising mainly on account of the Company's continued focus on 'Make in India' investments across sectors) and the estimate of tax expense for the year ending 31st March, 2020 have been re-measured. The resultant impact is being recognised over the current and the remaining quarters of the financial year.

Q6. Please provide a revenue split of the FMCG–Others Segment.

Answer: The Branded Packaged Foods Businesses represent the largest component of this segment, accounting for ~75% of Segment Revenue. The Personal Care Business and Education and Stationery Products Business cumulatively accounts for ~15% of Segment Revenue.

Q7. What are the new FMCG categories that the Company is likely to enter over the short to medium term?

Answer: With aspirations to become the No.1 FMCG player in India, the Company continuously evaluates opportunities to grow in the FMCG space.

The choice of category is guided by its growth prospects, profitability profile and the ability of the Company to effectively leverage its institutional strengths with a view to achieving leadership status within a reasonable time frame. Synergies with existing categories in terms of overlap of distribution reach, brand extension possibility, procurement efficiencies etc. are considered while choosing new categories.

The Company is in the process of scaling up its presence in Dairy & Beverages, Chocolates, Coffee and Frozen Snacks in the Branded Packaged Foods business and Liquids & Home Care in the Personal Care Products Business.

Q8. What is the margin profile of the Branded Packaged Foods Business?

Answer: The Branded Packaged Foods Businesses of the Company comprise 'Staples & Meals', 'Snacks', 'Dairy & Beverages', 'Biscuits & Cakes' and 'Chocolates, Coffee & Confectionery'. These Businesses have evolved over a period of time and are currently at different stages of their lifecycles. As such, the revenue dimensions, cost structures and profitability profiles of each of these businesses are distinct from the other. For example, EBIT margin is in the high single digit range for the Staples business (first full year of launch: 2002/03) while the same is in the mid-single digit range for the Snack Foods business (first full year of launch: 2007/08) representing upfront investments towards category development and brand building.

Overall, each category is striving towards achieving best-in-class margins within a reasonable period of time.

Q9. What is the margin profile of the Personal Care Products Business?

Answer: The Personal Care Products Business presently comprise 'Personal Wash & Hygiene', 'Fragrances', 'Home Care', 'Skin Care', 'Health' and 'Talc' categories. The Company continues to make significant investments in this Business primarily in the area of brand building, R&D and product development towards competing effectively with incumbent players comprising firmly entrenched MNCs and domestic companies.

Presently, each category is operating at industry benchmarked gross margins. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins progressively over the medium-term.

Q10. What are the Company's targets in the FMCG–Others space? What does the Company envision for this segment, over the medium and long-term?

Answer: ITC's endeavour is to become the No.1 FMCG player in India driven by the existing portfolio as well as entry into new categories. In this regard, the Company is aiming for revenue of Rs. 100,000 Crores from the new FMCG businesses by the year 2030.

Over the medium term, the Company seeks to grow revenues of each category within the FMCG-Others segment at a rate which is ahead of industry.

Q11. Would ITC contemplate acquisitions in order to achieve its vision in the Other FMCG segment?

Answer: ITC examines prospects for inorganic growth that arise from time to time not only in this business segment but also in the other businesses. The Company continues to evaluate opportunities to grow its businesses through Acquisitions and Joint Ventures and is guided by considerations such as strategic fit, valuation, financial viability, ease of integration etc.

The Company's 'Savlon' and 'Shower to Shower' brands, acquired earlier, have been leveraged to strengthen its position in the personal care space by expanding its existing product portfolio and gaining access to newer consumer segments and markets. The offerings have garnered significant consumer franchise and are well poised for rapid growth.

'Charmis' brand acquired by the Company in FY18 has been leveraged to re-launch moisturising skin creams with a fresh look & enhanced sensorial experience supported by a focussed campaign showcasing the brand's core value proposition - 'it is the goodness within that glows on the face'.

In FY19, Personal Care Products Business forayed into the floor cleaner segment under the 'Nimyle' brand. The range of herbal floor cleaners was extended to new markets even as it recorded robust growth in existing markets. Plans are on the anvil to scale up the brand's presence across target markets.

Q12. Please provide an update on the Company's progress in the FMCG-Others Segment during the quarter.

Answer: The FMCG-Others Segment delivered a resilient performance during the quarter which witnessed a further slowdown in consumption both in urban and rural markets. Categories with relatively higher rural salience were impacted the most. The impact of slow-down is being mitigated through several proactive measures such as enhancing direct reach, increasing the frequency of market servicing, introducing targeted offers for value seeking consumers, investing in fast growing channels such as modern trade/e-Commerce and extending credit judiciously to select trade partners.

Segment Revenue grew by 6.5% appx. on a comparable basis (excluding the Lifestyle Retailing Business) led by Atta, Potato Chips and Premium Cream Biscuits in the Branded Packaged Foods Businesses, Liquids (Handwash & Bodywash) in the Personal Care Products Business and Notebooks in the Education & Stationery Products Business. Segment EBITDA grew by 39% to Rs. 221 crores, with margins expanding by ~170 bps, despite stepped up marketing investments, gestation and start-up costs of new categories / new facilities.

The Branded Packaged Foods Businesses delivered a steady performance during the quarter, anchored on innovative product launches and impactful communication campaigns in conventional and digital media.

- In the Staples, Snacks and Meals Business, 'Aashirvaad' atta continued to post robust growth, consolidating its leadership position across markets. Increasing consumer traction for 'Bingo!' Potato Chips and Tedhe Medhe continued to drive growth in the Snacks Business. 'Bingo! Starters', a baked and protein rich snack launched in the previous quarter, is being scaled up following encouraging response from discerning consumers. During the quarter, the Business augmented its 'Bingo! No Rulz' portfolio with the launch of No Rulz Curlz, a corn based baked snack in exciting flavours of Masala and Cheese.

- The Biscuits and Cakes Business continued to pursue portfolio premiumisation with 'Dark Fantasy Choco Fills' witnessing further acceleration in growth momentum driven by superior product attributes, focused communication, efficient distribution and consumer activation. The recently launched Bounce Cake variants continue to receive excellent response from consumers and are now available in all target markets. During the quarter, the Business launched 'Sunfeast' Veda Marie Light, a healthy offering infused with 5 natural ingredients, strengthening the brand's 'chai ka perfect partner' value proposition.

- In the Confectionery Business, multi-unit packs and higher salience of 'Re. 1 and above' products contributed to portfolio premiumisation. The recently launched 'Candyman' Fantastik, a crispy wafer roll filled with luscious choco crème, continues to garner consumer franchise across launch markets. The range was augmented with the introduction of 'Candyman' Fantastik Choco Mocha, a limited edition variant for the gifting space. The Chocolates Business continued to focus on augmenting its product portfolio by introducing several world-class and distinctive variants. During the quarter, the Business launched 'Fabelle' Dark Gianduja, made from a fine blend of rich dark and milk chocolate giving it a balanced bitter and sweet experience, and a range of assorted chocolate gift packs and hampers, providing consumers a luxurious chocolate experience to make the upcoming festival season unforgettable.

- In the Dairy & Beverages Business, the recently launched premium range of juices comprising 3 differentiated flavours, viz., Ratnagiri Alphonso, Himalayan Mixed Fruit and Dakshin Pink Guava in a unique transparent bottle format, continued to receive excellent response from consumers. 'Aashirvaad Svasti' pouch milk gained strong consumer traction on the back of high quality standards and superior taste profile, in Bihar and West Bengal where the product is currently available. Similarly, the 'Sunfeast Wonderz Milk' range of milk shakes has received encouraging response and is being extended to other markets.

The Personal Care Products Business continued to focus on product mix enrichment led by sustained growth in the Liquids (Handwash and Bodywash) and Floor Cleaner segments. The quarter witnessed a spate of innovative product launches by the Business. The Deodorants product portfolio stood expanded with the launch of two refreshing variants under the 'Engage' brand – Engage Intrigue and Engage Spirit. Product range in the Bodywash segment was augmented with the launch of Vivel Glycerin+ Honey variant. The 'Dermafique' range of skin care products was strengthened with the launch of two new variants - Hydra Tonique Gel Crème and Hydra Tonique Gel Fluid, which are DermaHydration systems enriched with differentiated ingredients to provide increased hydration and prevent transepidermal water loss.

The Branded Packaged Foods and Personal Care Products Businesses continued to focus on deepening consumer engagement through clutter-breaking and high decibel campaigns across key brands in the conventional and social media platforms. The Businesses continue to leverage state-of-the-art integrated consumer goods manufacturing facilities (ICMLs) to service proximal markets in a highly efficient and responsive manner.

The Education and Stationery Products Business strengthened its leadership position in the Notebooks category leveraging a pipeline of innovative products of superior quality and enhanced consumer connect. A dedicated manufacturing facility for notebooks, equipped with state-of-the-art machinery was commissioned at Gollapudi, Andhra Pradesh. The facility will enable manufacturing of a complete range of high quality and differentiated notebooks and drive higher operational efficiencies.

In the Incense Sticks (Agarbatti) and Safety Matches Business, 'Mangaldeep' agarbattis continue to delight consumers, providing innovative and specially crafted fragrances. During the quarter, the Business launched 'Mangaldeep Temple - Lord Jagannath's Favourite Fragrances', a first-of-its-kind agarbatti with dual-fragrance sticks encompassing fragrances of items considered to be amongst the God's favourite. Manufactured by local rural women-based self-help groups, the new variants endeavour to help consumers experience the divinity of the temples in their homes.

Please refer to the FMCG - Others section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2019 and Media Releases on quarterly results for further details.

Q13. What is the progress on upcoming integrated consumer goods manufacturing facilities (ICMLs) of the Company?

Answer: The Company continues to make investments in Integrated Consumer Manufacturing Facilities (ICMLs) towards augmenting the manufacturing and sourcing footprint across categories with a view to improving market responsiveness, leveraging fiscal incentives and reducing the cost of servicing proximal markets. These ICMLs are expected to set new benchmarks leveraging scale over a period of time and improving cost efficiencies while ensuring best-in-class product quality. Significant progress was made during the quarter towards constructing state-of-the-art ICMLs at Odisha and Hyderabad towards supporting the rapid scale-up plans in the FMCG Businesses.

Q14. Please provide an update on the Cigarettes business. What is the Company's view on cigarette volume trends over the medium to long term?

Answer: The Business sustained its leadership position in the industry through its unwavering focus on nurturing a portfolio of world-class brands anchored on superior consumer insights, a robust innovation pipeline and superior product development capabilities. The Business continues to introduce new variants and augment its product portfolio catering to continuously evolving consumer preferences. Key market interventions in recent times include the launch of innovative and differentiated offerings such as Gold Flake Neo and Classic Rich & Smooth in the premium end, deployment of focused offers under the 'American Club', 'Wave', 'Player's Gold Leaf', 'Pall Mall' and 'Flake' trademarks to effectively counter competition in strategic markets.

Performance during the quarter reflects the persistent weakness in the overall demand environment, especially in rural markets and wholesale channel, and tight market liquidity conditions. Disruptions/floods in several markets exacerbated the situation.

A punitive and discriminatory taxation and regulatory regime, together with sharp increase in illegal trade in recent years, continues to pose significant operating challenges to the legal cigarette industry in the country. Excessive taxation has made legal, duty-paid cigarettes in India amongst the costliest in the world in terms of per capita affordability. The high rates of tax on cigarettes provide attractive tax arbitrage opportunities for illicit trade allowing sale of these cigarettes to consumers at prices much lower than those of duty-paid domestic cigarettes.

It may be recalled that tax incidence on cigarettes increased by over 20% in 2017-18, representing the combined impact of transition to GST and increase in Excise Duty announced in the Union Budget 2017. While stability in taxes since the introduction of GST in July 2017 has provided some relief to the legal cigarette industry, it is pertinent to note that the legal cigarette industry volumes remain significantly below June 2014 levels. Moderation in taxes is critical for addressing the interests of all the stakeholders of this industry, including the tobacco farmers, the Exchequer and the consumers.

It is pertinent to note that taxes on cigarettes are effectively about 55 times higher than that on other tobacco products on a per kg basis. Such disparity in taxation of tobacco products has caused a progressive migration from consumption of duty-paid cigarettes to other lightly taxed / tax-evaded forms of tobacco products, comprising illegal cigarettes and bidis, chewing tobacco, gutkha, zarda, snuff, etc. While the share of legal cigarettes in total tobacco consumption in the country has declined considerably over the years, aggregate tobacco consumption has increased. As a result, despite accounting for merely 10% of the tobacco consumed in the country, duty-paid cigarettes contribute more than 86% of the revenue generated from the tobacco sector.

The cost disadvantage faced by duty-paid cigarettes as compared to illegal cigarettes is exacerbated by the fact that duty-paid cigarettes comply fully with provisions of applicable Indian legislation like The Cigarettes and Other Tobacco Products (Prohibition of Advertisement and Regulation of Trade and Commerce, Production, Supply and Distribution) Act, 2003 (COTPA) and bear the statutorily mandated pictorial and textual warnings covering 85% of the surface area of the packet (one of the largest in the world). New graphic health warnings with even more gruesome images have been introduced from 1st September 2019. The excessively large GHWs prevent consumers from making an informed choice in a competitive market, since they are denied adequate information about the brand on the cigarette packages. The Company believes that such GHW also devalues the Intellectual Property Rights of brand owners and sub-optimises the large investments made over the years in creating and nurturing the brands. On the other hand, smuggled illegal cigarettes either do not bear the mandated pictorial or textual warnings or bear much smaller pictorial warnings as per the tobacco laws of the countries from where these cigarettes are sourced, creating a perception that these smuggled cigarettes are relatively 'safer'.

It may be noted that, according to Euromonitor International, India is now the 4th largest market for illegal cigarettes in the world. It is estimated that on account of illegal cigarettes alone, the revenue loss to the Government is more than Rs. 13000 crores per annum. In respect of the other tobacco products also, the revenue losses are significant since about 68% of the tobacco consumed in the country remains outside the tax net.

The unfettered growth of illegal cigarettes in the country has caused collateral damage to the Indian tobacco farmers. In India, cigarettes are manufactured largely using Flue Cured Virginia Tobacco (FCV) which is grown in the states of Andhra Pradesh, Telangana and Karnataka. FCV tobaccos are also traded internationally and India is an exporter of this commodity. Since smuggled international brands of cigarettes do not use Indian tobaccos, in addition to revenue losses, the growth of the illegal cigarette trade has also resulted in a drop in demand for Indian FCV tobaccos in the domestic market. This, along with lack of export opportunities (favourable prices of competing origins and lower Indian crop), has adversely impacted earnings of the Indian tobacco farmer. It is estimated that in the four years since 2013-14, Indian tobacco farmers have suffered a cumulative drop in earnings of over Rs. 4000 crores. These developments have had a devastating impact on the Indian tobacco farmer and the 46 million dependent on the tobacco value chain for their livelihood. Ensuring stability in domestic demand is vital for the sustenance of tobacco farmers and to prevent risk exposure to the vagaries of volatility in international markets.

As in the past, the Company continues to make representations to policy makers for equitable, non-discriminatory, pragmatic, evidence based regulations and taxation policies that balance the economic imperatives of the country and the tobacco control objectives, cognising for the unique tobacco consumption pattern in India.

Please refer to the FMCG - Cigarettes section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2019 and Media Releases on quarterly results for further details.

Q15. Please provide an update on the Company's plans in the 'Electronic Nicotine Delivery Systems (ENDS)' space?

Answer: The Government of India, vide an ordinance dated 18 September 2019 has prohibited Production, Manufacture, Import, Export, Transport, Sale, Distribution, Storage and Advertisement of Electronic Cigarettes imposing stringent punishment with imprisonment of up to 1 year or a fine of up to Rs 1 lakh, or both for the first offence and imprisonment of 3 years or a fine up to Rs 5 lakhs or both, for subsequent offence.

Q16. Please provide an update on the Company's Hotels business.

Answer: The Business recorded a healthy growth in Segment Revenue and Segment EBITDA during the quarter driven by robust performance of recently commissioned hotels. Segment Results include the impact of additional depreciation pertaining to new properties. Sluggish demand environment contributed to relatively muted performance of the other properties.

New hotels in ITC’s portfolio – ITC Kohenur, ITC Grand Goa and ITC Royal Bengal continue to receive excellent response from discerning guests, raising the bar of service excellence. The Kolkata complex comprising ITC Royal Bengal and ITC Sonar houses 15 signature F&B outlets with access to over 100,000 sq.ft of banqueting space, making it the most sought after F&B and banqueting destination in the city.

The Business made steady progress during the quarter in the construction of an ITC Hotel in Ahmedabad and WelcomHotels in Guntur & Bhubaneswar. The WelcomHotel Amritsar project has been completed and the 101-room hotel is expected to commence operations on November 1, 2019.

Please refer to the Hotels section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2019 and Media Releases on quarterly results for further details.

Q17. Please provide an update on the Company's Agri Business.

Answer: The Business continues to focus on strengthening its portfolio of value-added products to cater to the specific requirements of the food service channel. During the quarter, the ‘ITC Master Chef’ range of Frozen Snacks was augmented with the launch of several delectable variants viz., Achaari Beetroot Kebab, Mediterranean Chicken Kebab, Caribbean Chicken pops, etc. Segment Revenue grew by 19.3% as the Business leveraged trading opportunities especially in Oilseeds & Pulses and scaled up value-added products. Subdued demand for leaf tobacco in international markets, relatively steeper depreciation in currencies of competing origins and adverse business mix weighed on Segment Results.

The deep rural linkages and agri-commodity sourcing expertise resident in the Agri Business, including value-addition through identity preservation, traceability and certification are a critical source of competitive advantage for the Company. The Business stepped up strategic sourcing of agri commodities in the current quarter to support the growing requirements of the Branded Packaged Foods Businesses. Milk sourcing network in West Bengal continues to be scaled up to support the growing franchise of the Aashirvaad Svasti range of dairy products.

Please refer to the Agri Business section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2019 and Media Releases on quarterly results for further details.

Q18. Please provide an update on the Company's Paperboards, Paper and Packaging Segment.

Answer: The paperboards business recorded robust growth driven by strong volume growth in the Value Added Paperboard segment and product mix enrichment. This was partially offset by muted demand for packaging & printing products due to sluggish demand conditions in the FMCG and liquor industry. Segment Results registered a healthy growth driven by product mix enrichment, strategic investments in imported pulp substitution and benefits of a cost-competitive fibre chain.

Capacity utilisation of the recently commissioned facilities, viz., Value Added Paperboard machine and Bleached Chemical Thermo Mechanical Pulp mill, was further ramped up during the quarter. The Business continues to make structural interventions in the areas of strategic cost management and import substitution towards enhancing its market standing and competitive advantage.

Please refer to the Paperboards, Paper & Packaging section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2019 and Media Releases on quarterly results for further details.

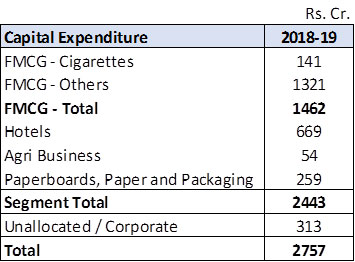

Q19. Please provide details of the Company's Capital expenditure by Business.

Answer: The Company's Capex during the last financial year is tabulated below:

Q20. Please provide an overview of the capex plan of the Company.

Answer: The Company's capex plans are directed primarily towards capacity gearing, productivity enhancement, ensuring the highest standards in quality and environment, health & safety, and R&D.

One of the key elements of the capex plan going forward is to invest in setting up state-of-the-art owned integrated consumer goods manufacturing and logistics facilities across regions in line with long-term demand forecasts. Currently, over 15 projects are underway and in various stages of development - from land acquisition/site development to construction of buildings and other infrastructure.

The Hotels Business made steady progress during the quarter in the construction of an ITC Hotel in Ahmedabad and WelcomHotels in Guntur & Bhubaneswar. Most of the planned investments in the current capex cycle would have been completed with the commissioning of these hotels. Going forward, the Company shall enhance the scale of the Business by adopting an 'asset-right' strategy that envisages building world-class tourism assets for the nation and growing the footprint of managed properties by leveraging its hotel management expertise.

The major items of capital expenditure in the Paperboards, Paper and Packaging segment going forward comprise paperboards capacity augmentation/machine rebuild at the Bhadrachalam unit and capacity augmentation in Cartons and Flexibles packaging at the Tiruvottiyur and Haridwar unit.

Overall, the Company estimates capex of around 10,000 Crores over the next 3 years (excluding investments for inorganic growth and acquisition of trademarks, other intellectual property, etc.). However, this would depend on several factors such as pick-up in economic activity and improvement in demand conditions, timely acquisition of land at desirable locations, obtaining approvals from the concerned authorities in a timely manner etc.

Q21. Why has the Segment Capital Employed increased by from Rs. 23,909 Crores as at 30th Sep 2018 to 25,821 Crores as at 30th Sep 2019?

Answer: The increase in Segment Capital Employed is primarily on account of capacity augmentation in FMCG Business, ongoing investments in Hotels and stepped up strategic sourcing of agri commodities in the current quarter to support the growing requirements of the Branded Packaged Foods Businesses.

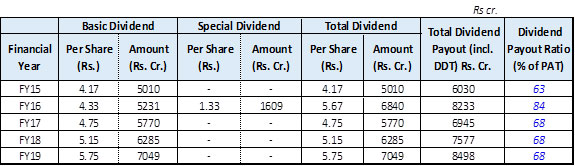

Q22. What are the dividend payout trends in recent years? What is the Dividend policy of the Company?

Answer: Dividend paid out by the Company for the last 5 years is given below:

Please refer to the following link for the Dividend Distribution policy of the Company.

http://www.itcportal.com/about-itc/policies/dividend-distribution-policy.pdf

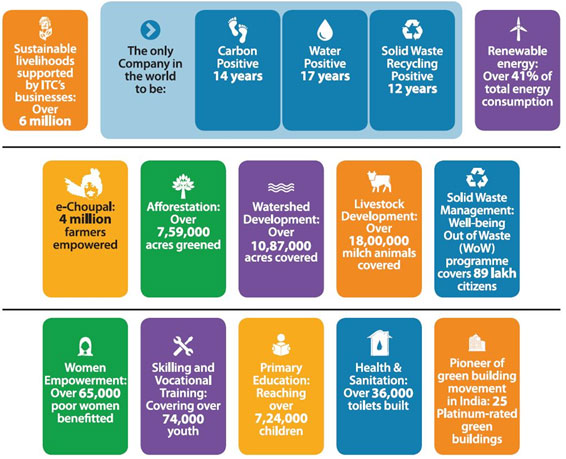

Q23. Please explain the Company's 'Triple Bottom Line' philosophy.

Answer: Inspired by the opportunity to sub-serve larger national priorities, the Company redefined its Vision to not only reposition the organisation for extreme competitiveness but also make societal value creation the bedrock of its corporate strategy. This super-ordinate Vision spurred innovative strategies to address some of the most challenging societal issues including widespread poverty, unemployment and environmental degradation. The Company's sustainability strategy aims at creating significant value for the nation through superior 'Triple Bottom Line' performance that builds and enriches the country's economic, environmental and social capital. The sustainability strategy is premised on the belief that the transformational capacity of business can be very effectively leveraged to create significant societal value through a spirit of innovation and enterprise.

It is pertinent to note that ITC has been ranked #1 globally amongst peers (comprising companies with market capitalisation between USD 38 Bln. and USD 51 Bln.) and overall #3 globally on ESG performance in the Food Products industry by Sustainalytics – a renowned global ESG ratings company. ITC has been rated ‘AA’ by MSCI-ESG - the highest among global tobacco companies.

ITC is a global exemplar in sustainability, the key highlights of which are given below:

ITC has recently launched a first-of-its-kind model for sustainable management of Multi-Layered Plastic packaging waste in Pune in partnership with SWaCH, a leading waste-pickers cooperative and with active patronage and cooperation from the Pune Municipal Corporation. Leveraging the expertise resident in the ITC Life Sciences and Technology Centre, viable options have been found to convert multi layered plastic waste into useful items of consumption. Efforts are underway to scale up this initiative and replicate the model in other parts of the country.

To contribute to the nation's efforts in combating climate change, the Company's strategy of adopting a low-carbon growth path is manifest in its growing renewable energy portfolio, establishment of green buildings, large-scale afforestation programme and achievement of international benchmarks in energy and water consumption. In FY 18-19, about 41% of the Company's total energy requirements were met from renewable energy sources - a creditable performance given its expanding manufacturing base. The Company is well positioned to benefit from energy conservation and renewable energy promotion schemes such as Perform, Achieve and Trade (PAT) and Renewable Energy Certificates (RECs) promoted by the Government of India. As a responsible corporate citizen, the Company has made a commitment to reduce dependence on energy from fossil fuels. Accordingly, all factories incorporate appropriate green features and premium luxury hotels and office complexes continue to be certified at the highest level by either the US Green Building Council, Indian Green Building Council or the Bureau of Energy Efficiency (BEE).

The Company has adopted a comprehensive set of sustainability policies that are being implemented across the organisation in pursuit of its 'Triple Bottom Line' agenda. These policies are aimed at strengthening the mechanisms of engagement with key stakeholders, identification of material sustainability issues and progressively monitoring and mitigating the impacts along the value chain of each Business.

The Company's 16th Sustainability Report, published during the year detailed the progress made across all dimensions of the 'Triple Bottom Line' for the year 2018-19. This report is in conformance with the latest Global Reporting Initiative (GRI) Guidelines - G4 under "In Accordance - Comprehensive" category and is third-party assured at the highest criteria of "reasonable assurance" as per International Standard on Assurance Engagements (ISAE) 3000.

Please refer to the following link

1. 16th Sustainability Report: https://www.itcportal.com/sustainability/sustainability-report-2019/sustainability-report-2019.pdf for Sustainability Report 2019.

2. ITC Sustainability at a glance: https://www.itcportal.mobi/itc-csr-brochure.pdf

In addition, the Business Responsibility Report (BRR), annexed to the Report and Accounts 2019, maps the sustainability performance of the Company against the reporting framework suggested by Securities and Exchange Board of India.

The Company has prepared its Integrated Report for the financial year 2018-19. As a green initiative, the Report has been hosted on the Company's corporate website at https://www.itcportal.com/about-itc/shareholder-value/index.aspx