Q3 FY15 Results Update and Frequently Asked Questions

Q1. What is ITC's Vision and Mission?

Answer:

Vision:

Sustain ITC's position as one of India's most valuable and admired corporations through world-class performance, creating growing value for the Indian economy and the Company's stakeholders.

Mission:

To enhance the wealth generating capability of the enterprise in a globalising environment, delivering superior and sustainable stakeholder value.

Q 2. How does the Company effectively manage a highly diversified business portfolio? What is the Company's Corporate Governance structure?

Answer: ITC's 'strategy of organization' is crafted in a manner that enables focus on each business while harnessing the diversity of the portfolio to create unique sources of competitive advantage. Please refer to the following link http://www.itcportal.com/about-itc/values/corporate-governance-structure.aspx for details of ITC's 3-tier Governance Structure.

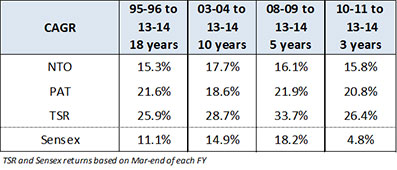

Q 3. What is the Company's shareholder value creation track record?

Answer: ITC has been a consistent performer in terms of shareholder value creation. During the period 1995/96 to 2013/14, Total Shareholder Returns have clocked compound annual growth rate of 25.9% significantly outperforming the Sensex. A snapshot of ITC's financial track record across different time horizons is given below:

Q 4. What is the rationale for the Company's investments in the FMCG space?

Answer: ITC's entry into a wider range of FMCG products in recent years is in line with its strategy of creating multiple drivers of growth. The Indian FMCG industry is expected to grow rapidly driven by increasing affluence, urbanisation and a young workforce on the one hand and relatively low levels of penetration and per capita usage on the other. The Company seeks to participate in the exciting growth prospects of the FMCG industry by leveraging its institutional strengths namely, deep consumer insight, proven brand building capability, manufacturing excellence, deep and wide distribution network, packaging and printing knowhow, agri-commodity sourcing expertise and cuisine knowledge.

Q 5. Please provide an overview of the Company's progress in the new FMCG businesses? What is the Company's goal in the new FMCG businesses?

Answer: The new FMCG businesses comprising Branded Packaged Foods, Personal Care Products, Education & Stationery Products, Lifestyle Retailing, Incense Sticks (Agarbattis) and Safety Matches have grown at a compound annual rate of 22% over the last 5 years, crossing the Rs. 8000 crores mark during FY14.

ITC has established a vibrant portfolio of brands such as 'Aashirvaad', 'Sunfeast', 'Bingo!', 'YiPPee!', 'Candyman', 'mint-o', 'Kitchens of India' in the Branded Packaged Foods space; 'Classmate' and 'Paperkraft' in Education & Stationery products market; 'Essenza Di Wills', 'Fiama Di Wills', 'Vivel', 'Superia' and 'Engage' in the Personal Care products segment; 'Wills Lifestyle' and 'John Players' in the Lifestyle Retailing business; 'Mangaldeep' in Agarbattis, 'Aim' in Matches and so on. These brands, which have been built organically by the Company, have attained considerable size in a relatively short period of 10 years and in aggregate currently represent over Rs. 10000 crores in terms of annualised consumer spend - a feat perhaps unrivalled in the Indian FMCG industry. It is pertinent to note that these brands support the competitiveness of domestic value chains of which they are a part and create and retain value within the country.

ITC's relentless focus on quality, innovation and differentiation backed by deep consumer insights, world-class R&D and an efficient and responsive supply chain reinforces its market standing in the Indian FMCG industry.

ITC's endeavour is to become the No.1 FMCG player in India driven by the existing portfolio as well as entry into new categories.

Q 6. Would ITC contemplate acquisitions in order to achieve its vision in the Other FMCG segment?

Answer: ITC examines prospects for inorganic growth that arise from time to time not only in this business segment but also in the other businesses. The Company continues to evaluate opportunities to grow its businesses through acquisitions and Joint Ventures and is guided by considerations such as strategic fit, valuations, financial viability, ease of integration etc.

Q 7. Please explain the Company's 'Triple Bottom Line' philosophy

Answer: The Company's Vision to subserve larger national priorities and create enduring societal value is the inspiration for its multi-dimensional sustainability initiatives that are today acknowledged as global exemplars. The Company's sustainability strategy aims to significantly enhance national wealth through superior 'Triple Bottom Line' performance that builds and enriches the country's economic, environmental and societal capital. It is premised on the belief that the transformational capacity of business can be effectively leveraged to create significant societal value through a spirit of innovation and enterprise. The Company's 'Triple Bottom Line' contribution is manifest in the creation of innovative models that enable the replenishment of natural capital and augmentation of sustainable livelihoods.

The Company's inclusive models and value chains have supported the creation of 6 million sustainable livelihoods, largely amongst the disadvantaged sections of society. The Company has sustained its position as the only company in the world of comparable dimensions to have achieved the global environmental distinctions of being carbon positive (for 9 consecutive years), water positive (for 12 years in a row) and solid waste recycling positive (for 7 years in succession).

The Company's renewable energy portfolio enables 38% of its total energy requirements to be met from clean resources - a remarkable achievement given the large manufacturing base of the Company. Further, all the premium luxury hotels and several factories of the Company are LEED (Leadership in Energy & Environmental Design) certified at the highest Platinum/Gold level by the US Green Building Council/Indian Green Building Council.

The Company's 11th Sustainability Report was published recently detailing the progress made across all dimensions of the 'Triple Bottom Line' for the year 2013-14. The report, independently assured by KPMG, conforms to the G4 Guidelines of the Global Reporting Initiative (GRI). This Report was one of the first in India to be prepared in accordance with the new G4 guidelines of the GRI. Please refer to the following link to view the report http://itcportal.mobi/sustainability/sustainability-report-2014/index.aspx

Q 8. Please provide an update of the Company's Social Investments Programme

Answer: The Company's Social Investments Programme aims to address the challenges arising out of poverty, environmental degradation and climate change through a range of activities with the overarching objective of creating sustainable sources of livelihood for stakeholders.

The footprint of the Company's Social Investments Programme has spread to 71 districts across the country and can be viewed at a glance in the following chart:

| Intervention Areas | Unit of Measurement | Cumulative till date |

|---|---|---|

| Total Districts Covered | Number | 71 |

| Social and Farm Forestry Soil and Moisture Conservation Programme |

Hectare Hectare |

194,955 171,626 |

| Sustainable Agricultural Practices Compost Units |

Number |

22,289 |

| Sustainable Livelihoods Initiative Cattle Development Centres Animal Husbandry Services |

Number Artificial Insemination doses (in lakhs) |

256 15.03 |

| Economic Empowerment of Women Self Help Group Members Livelihoods created |

Persons Persons |

22,072 42,819 |

| Primary Education Beneficiaries |

Children (in lakhs) |

4.00 |

| Health and Sanitation Low Cost Sanitary Units |

Number |

5,676 |

| Vocational Training Students Enrolled |

Number |

15,083 |

Q 9. Please provide a brief overview of Q3 FY15 results?

Answer: The Company's performance for Q3 FY15 reflects, inter alia, the full impact of the steep hike in Excise Duty on cigarettes announced in the Union Budget 2014 and sharp increases in VAT on cigarettes by Tamil Nadu, Kerala and Assam during the quarter. Cigarette Segment Revenue, as a consequence, remained flattish during the quarter compared to same period last year. This, coupled with a degrowth in Agri Business revenue - primarily due to lack of trading opportunities in Soya - led to a muted growth of 2.1% in Net Revenues for the quarter. Profit Before Tax at Rs. 3800.19 crores and Net Profit at Rs. 2635.00 crores, registered a growth of 10.5% each during the quarter. Earnings Per Share for the quarter stood at Rs. 3.30.

Q 10 (a). Why has 'Consumption of Raw Material etc. (net)' increased by Rs. 38 crores during Q3 FY15 as compared to Q3 FY 14?

Answer: Increase in Consumption of Raw Materials (net of changes in closing inventories of finished goods, work-in-progress & stock-in-trade and purchase of stock in trade) is in line with the revenue growth during the quarter.

Q 10 (b). Why has 'Other Expenditure' decreased by about Rs. 21 crores from Rs.1602 crores in Q3 FY14 to Rs.1582 crores in Q3 FY15?

Answer: Other Expenditure for Q3 FY15 is lower by 1.3% Vs. Q3 FY14 primarily due to muted revenue growth a/c lower volumes and favourable forex impact.

Q 11. Please provide an update on the Company's progress in the FMCG-Others Segment during the quarter

Answer: The FMCG-Others Segment registered a healthy revenue growth of 11.4% during the quarter amidst continuing weakness in discretionary demand.

The Branded Packaged Foods Businesses posted a healthy growth in revenues and enhanced market standing across categories by leveraging its portfolio of differentiated and innovative products.

In the Staples, Spices and Ready-to-Eat Foods Business, 'Aashirvaad' atta sustained its high growth trajectory, consolidating its leadership position across markets. The premium variants - 'Multi-grain' and 'Select' - continued to perform strongly with their share in sales mix increasing progressively.

The Snack Foods Business recorded robust growth in revenue with the 'Bingo!' range of savoury snacks rapidly gaining consumer franchise. 'Bingo! Yumitos' potato chips and finger snacks sub-brands - 'Tedhe Medhe' and 'Mad Angles' - were the key growth drivers during the quarter. In the Instant Noodles and Pasta categories, 'Sunfeast YiPPee!' sustained its high growth trajectory and enhanced market standing.

During the quarter, the Bakery and Confectionery Foods Business launched 'Sunfeast Yumfills Whoopie pie' - a premium chocolate-enrobed cake - in select markets. The product has met with encouraging consumer response and is being rolled out to target markets. The recently launched 'Sunfeast Mom's Magic' range of premium cookies witnessed good traction and garnered impressive consumer franchise in target markets.

The Personal Care Products Business continued to make steady progress in the Personal Wash and Deodorants categories. The 'Engage' range of deodorants, including the recently launched Cologne variants, continued to receive good response from consumers and grew at a rapid pace during the quarter.

Q 12. Please provide an update on the Cigarettes business

Answer: The challenging operating environment for the legal cigarette industry in India was exacerbated by the steep increase in Excise Duty announced in the Union Budget 2014 - the third year in a row. This includes a sharp increase of 72% on filter cigarettes of 'length not exceeding 65 mm', which has widened the price differential between legal and illegal cigarettes and made it extremely difficult for the legal cigarette industry to counter the unabated growth of illegal cigarettes in the country.

Over the last 3 years or so, the incidence of Excise Duty and VAT on cigarettes, at a per unit level, has gone up cumulatively by 75% and 165% respectively. It is pertinent to note that Kerala, Tamil Nadu and Assam, which together accounted for nearly 30% of the Company's sales volumes, have significantly increased VAT rate on cigarettes with effect from October 8th 2014, November 1st 2014 and November 20th 2014 respectively.

The combined impact of the sharp increase in Excise Duty and VAT as stated above is exerting unprecedented pressure on legal industry sales volumes. Besides adversely impacting the performance of the legal cigarette industry, this has led to sub-optimisation of the revenue potential from the tobacco sector.

A recent Government notification, to be effective from April 1st 2015, mandates larger graphic health warnings covering 85% of the surface area of both sides of the pack as compared to the current requirement of covering 40% of the area of one side of the pack. The proposed graphic health warnings are amongst the most stringent in the world and far larger than the top 5 cigarette markets viz. China, Russia, Indonesia, USA and Japan. This would lead to a spurt in sale of illegal cigarettes which will not carry the new warnings.

High incidence of taxation and a discriminatory regulatory regime on cigarettes in India have, over the years, led to a significant shift in tobacco consumption to lightly taxed or tax evaded tobacco products like bidi, khaini, chewing tobacco, gutkha and illegal cigarettes which presently constitute over 88% of total tobacco consumption in the country. Thus, the share of legal cigarettes in overall tobacco consumption has progressively declined from 21% in 1981-82 to below 12% in 2013-14 even as overall tobacco consumption has increased in India.

Such punitive taxation and discriminatory regulatory regime has also led to a manifold rise in illegal cigarette trade in the country. According to Euromonitor International, a renowned global research organisation, India is now the 5th largest illegal cigarette market in the world. In fact, illegal trade (comprising international smuggled and domestically manufactured tax evaded cigarettes) is estimated to constitute one-fifth of the overall cigarette industry in India resulting in a huge revenue loss of over Rs.7000 crores to the national exchequer.

There is an urgent need for stability in tax rates on cigarettes to reverse the undesirable consequences of a punitive and discriminatory tobacco taxation policy. The Company continues to engage with the concerned authorities, both at the Central Government and State level, highlighting the need for moderation in tax rates on cigarettes to maximize the revenue potential from the tobacco sector and contain the growth of the illegal segment.

Please refer to the FMCG - Cigarettes section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2014 and Media Releases on quarterly results for further details.

Q 13. Please provide an update on the Company's Agri Business

Answer: During the quarter, Segment Revenue degrew by 10.6% primarily due to lack of trading opportunities in Soya due to higher crop output in USA, Brazil and Argentina. Segment Results, however, recorded a growth of 16.3% on the back of improved margins due to lower share of commodity trading business in sales mix.

The Business provides strategic sourcing support to the Company's Cigarettes Business and is the leading exporter of quality Indian tobacco. The declining trend of global cigarette demand due to steep hikes in taxation and the impact of stringent regulatory measures covering cigarette marketing, packaging/labelling and usage of additives continues to weigh on the prospects of leaf tobacco exports from India. The Business continues to leverage its crop development expertise and world-class processing facilities and play a pioneering role in positioning India as a preferred source of leaf tobacco in the global market.

The Company's deep rural linkages and expertise in agri-commodity sourcing is a critical source of competitive advantage for the Branded Packaged Foods business. Given the volatile market conditions caused by climatic variations, changes in government policies and global demand-supply dynamics, the Company has over the years invested in building competitively superior agri-commodity sourcing expertise through multiple business models, geographical spread and customised infrastructure. These capabilities and infrastructure have created structural advantages that facilitate competitive sourcing of agri raw materials for the Company's Aashirvaad (atta & spices) and Bingo! Yumitos (potato chips) brands. The Business continues to focus on increasing the overall efficiency of procurement by pursuing cost optimisation initiatives including reducing distance travelled and eliminating non-value adding activities

Please refer to the Agri Business section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2014 and Media Releases on quarterly results for further details.

Q 14. Please provide an update on the Company's Hotels business.

Answer: The Hotels industry continued to be impacted by a weak pricing scenario in the backdrop of excessive room inventory in key domestic markets. While Segment Revenue registered a growth of 4.7%, Segment Results were impacted by additional depreciation charge for the quarter due to revision in the useful life of fixed assets in accordance with the provisions of Schedule II to the Companies Act, 2013 and gestation costs of new properties - ITC Grand Bharat and My Fortune, Bengaluru.

During the quarter, the Company unveiled its latest offering in the super premium segment - ITC Grand Bharat near Gurgaon. Envisioned as a supreme leisure getaway destination, this sprawling 'Luxury Collection' resort is situated in an idyllic expanse amidst the Classic Golf Resort - a 27-hole Jack Nicklaus designed signature golf course - surrounded by the majestic Aravalis and dotted with pristine lakes. ITC Grand Bharat promises to deliver the finest luxury experience to guests with 100 Deluxe Suites and 4 Presidential Villas, a wide range of fine dining restaurants, signature spa 'Kaya Kalp -The Royal Spa', a host of recreational and cultural activities and a world-class meeting/ banqueting venue.

The Company's Hotels Business comprises 98 properties across the country under 4 distinct brands - 'ITC Hotels' in the Luxury segment, 'WelcomHotel' in the Upper-upscale segment, 'Fortune Hotels' in the Upscale & Mid-market space and 'WelcomHeritage' in the Leisure & Heritage segment. In addition to these brands, the Business has licensing and franchising agreements for two brands - 'The Luxury Collection' and 'Sheraton' with Starwood Hotels & Resorts.

With all luxury properties achieving the LEED (Leadership in Energy and Environmental Design) Platinum rating, 'ITC Hotels' is the greenest luxury hotel chain in the world. Further, in line with the Company's commitment to the 'Triple Bottom Line' the Hotels Business is targeting to grow renewable energy usage from the current level of 55% (FY14) of total electrical energy requirements to around 80% by 2016.

Please refer to the Hotels section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2014 and Media Releases on quarterly results for further details.

Q 15. Please provide an update on the Company's Paperboards, Paper and Packaging Segment.

Answer: The Paperboards, Paper & Packaging segment was impacted by the slowdown in the FMCG and Cigarette industry. Consequently, Segment Revenue and profit were impacted during the quarter.

In the Paperboards & Specialty Papers Business, the Company continues to focus on the Value Added Paperboard segment in which it is a clear market leader. The new paperboard machine, commissioned in March 2013 at the Bhadrachalam plant, has been fully ramped up and has helped in further consolidating its pre-eminent market position in the Value Added Paperboard segment. This state-of-the-art paperboard machine is highly energy efficient with an installed capacity of over 1 lakh tonnes per annum. With this, the total capacity of the Bhadrachalam plant stands at over 5.5 lakh tonnes per annum, thereby sustaining its position as the single largest integrated pulp and paperboard/ paper unit in India. The Business completed its pulp mill expansion project during the quarter, augmenting in-house capacity by 30,000 Tonnes per annum at the Bhadrachalam unit. The facility is currently under stabilisation.

With strong forward linkages with the Company's Education & Stationery Products SBU, the Business has emerged as a leading player in the 'Writing and Printing' paper segment and plans are on the anvil to enhance its market presence. In the 'Specialty Paper' segment, the Business remains the market leader in Decor grades and the largest manufacturer of cigarette tissue in India.

In the Packaging and Printing Business, despite a challenging operating environment, the Business recorded a robust growth in revenues leveraging its state-of-the-art facilities across multiple packaging platforms to provide superior and comprehensive solutions to customers. Consequently, the Business strengthened its market standing as a leading supplier of value added packaging in Cartons and Flexibles. Further, the Business continued to provide strategic support to the Company's FMCG businesses by providing innovative packaging solutions, faster turnarounds of new designs, ensuring security of supplies and delivering benchmarked international quality packaging at competitive cost.

Please refer to the Paperboards, Paper & Packaging section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2014 and Media Releases on quarterly results for further details.

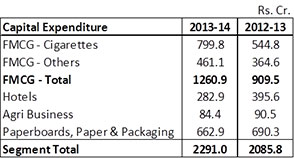

Q 16. Please provide details of the Company's Capital expenditure by Business segment.

The Company's Capex during the last two financial years is tabulated below:

Q 17. Why has the Segment Capital Employed increased by Rs. 1652 crores from Rs. 18939 crores as at 31st Dec 2013 to Rs. 20591 crores as at 31st Dec 2014?

Answer: The increase in Segment Capital Employed was primarily on account of higher Net Fixed Assets (net of depreciation) towards capacity augmentation in FMCG businesses, ongoing investments in Hotels, and cost reduction related investments in Paperboards, Paper and Packaging business. The balance increase was on account of higher Working Capital primarily due to increase in wheat, leaf tobacco and pulp inventory in line with the scale up in businesses.