Q3 FY17 Results Update and Frequently Asked Questions

Q1. What is ITC's Vision and Mission?

Answer:

Vision:

Sustain ITC's position as one of India's most valuable and admired corporations through world-class performance, creating growing value for the Indian economy and the Company's stakeholders.

Mission:

To enhance the wealth generating capability of the enterprise in a globalising environment, delivering superior and sustainable stakeholder value.

Q2. How does the Company effectively manage a highly diversified business portfolio? What is the Company's Corporate Governance structure?

Answer: ITC's 'Strategy of Organisation' is crafted in a manner that enables focus on each business while harnessing the diversity of the portfolio to create unique sources of competitive advantage. Please refer to the following link http://www.itcportal.com/about-itc/values/corporate-governance-structure.aspx for details of ITC's 3-tier Governance Structure.

Q3. What is the Company's shareholder value creation track record?

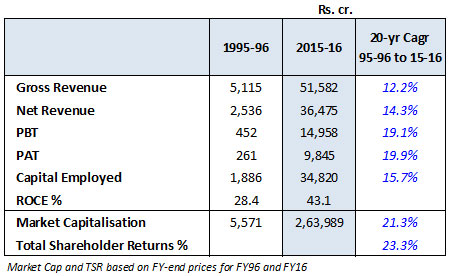

Answer: ITC is a consistent performer in terms of shareholder value creation. During the period 1995/96 to 2015/16, Total Shareholder Returns have clocked compound annual growth rate of 23.3% significantly outperforming the Sensex (10.6%).

Note: Numbers stated above are as per previous GAAP

Q4. What is the value added by the Company? What is the Company's contribution to the exchequer?

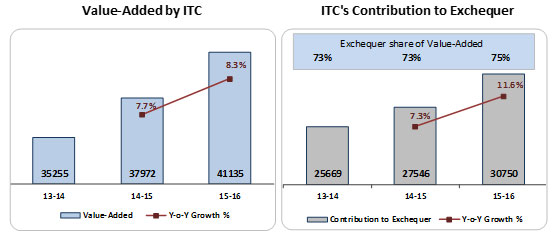

Value-Added by the Company, i.e. the value created by the economic activities of the Company and its employees, grew by 8.3% over 2014-15 to Rs. 41135 crores in 2015-16. The Company's Contribution to Exchequer in 2015-16 stood at Rs. 30750 crores representing a growth of 11.6% over last year. The incremental Value-Added during the year by the Company accrued entirely to the Exchequer. Share of Contribution to Exchequer in total Value-Added by the Company thereby increased further - from 73% in 2014-15 to 75% in 2015-16.

The Company remains amongst the Top 3 Indian corporates in the private sector in terms of Contribution to Exchequer.

Q5. Please provide a brief overview of Q3 FY17 results.

Answer: The operating environment was rendered extremely challenging during the quarter. FMCG sales were adversely impacted as a result of lower consumer offtake and reduction in trade pipelines particularly in the immediate aftermath of the Government's decision to withdraw specified high denomination currency notes. While the impact was felt across all operating segments, sales of biscuits, snacks, noodles, personal care products and branded apparel were impacted the most in the initial phase. The Company also had to contend with continuing regulatory and taxation pressures on the Cigarette business, rising input prices in the FMCG businesses and subdued demand conditions in the Hotels and Paperboards, Paper & Packaging segments.

The Company delivered steady performance during the quarter amidst the challenging business context as aforestated. Revenue from Operations for the quarter stood at Rs. 13470.89 crores representing a growth of 4.5%. Profit Before Tax at Rs. 3954.20 crores and Net Profit at Rs. 2646.73 crores registered a growth of 2.8% and 5.7% respectively during the quarter. Earnings Per Share for the quarter stood at Rs. 2.18. Total Comprehensive Income (TCI) for the quarter stood at Rs. 2485.12 crores (for the quarter ended 31st December, 2015: Rs. 2787.07 crores).

Q6. (a). Why has 'Consumption of Raw Material etc. (net)' increased by Rs. 349 crores during Q3 FY17 as compared to Q3 FY16?

Answer: Increase in Consumption of Raw Materials (net of changes in closing inventories of finished goods, work-in-progress & stock-in-trade and purchase of stock-in-trade) was primarily due to rising input costs and higher share of Agri Business.

Q6. (b). Why has 'Other Expenditure' declined by about Rs. 40 crores from Rs. 1793 crores in Q3 FY16 to Rs. 1753 crores in Q3 FY17?

Answer: Other Expenditure for Q3 FY17 is lower by 40 cr. Vs. Q3 FY16 mainly due to lower marketing spends and freight cost.

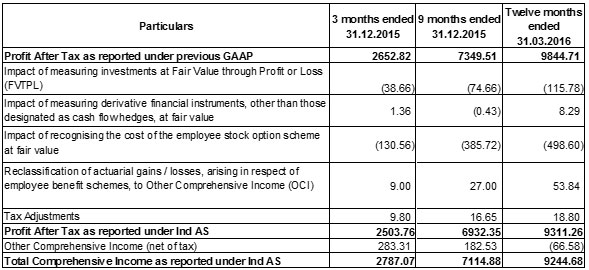

Q7. Please provide a reconciliation of Financial results as reported as per Ind-AS to those reported under previous GAAP

Answer: Reconciliation of the standalone financial results reported as per Ind-AS to those reported under previous Generally Accepted Accounting Principles (GAAP) are summarised as follows:

Please refer to Notes 5 (i) to (iv) to the Statement of Standalone Unaudited Financial Results for the Quarter ended 31st December 2016 for details on exemption applied at transition to Ind-AS and other key differences in accounting as compared to previous GAAP.

Q8. Please provide an update of the Company's progress in the FMCG - Others businesses.

Answer: The FMCG industry faced another challenging year in 2015-16 with demand conditions remaining sluggish for the third year in succession. The slowdown in the broader economy - as reflected by the marked deceleration in Nominal GDP growth, the absence of any material pick-up in consumption expenditure and headwinds in rural demand due to the second successive year of sub-par monsoons - was manifest in the Company's operating segments in the FMCG space. The year also witnessed price deflationary conditions with industry players passing on the benefit of decline in input prices to consumers with a view to bolstering sales volumes.

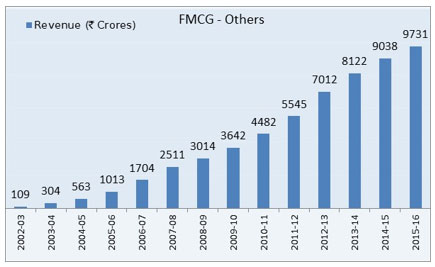

Against the backdrop of such a challenging operating environment, the Company sustained its position as one of the fastest growing FMCG businesses in the country. The Company's FMCG-Others Businesses clocked Segment Revenue of Rs. 9731.17 crores in 2015-16, representing a growth of 7.7% over the previous year. While revenue growth during the year was relatively subdued, it is pertinent to note that apart from the factors as aforestated, the Company had to contend with regulatory issues surrounding the Noodles industry (largely pertaining to products of the lead competitor) and synchronisation of trade pipeline in the later part of the year ahead of the ensuing season in the Notebooks category. Segment Results for 2015-16 improved to Rs. 71 crores from Rs. 34 crores in 2014-15, after absorbing the gestation costs of new categories viz., Juices, Gums, Dairy and Health and Hygiene and significant brand investments towards communicating the superior value proposition offered by YiPPee! Noodles, besides a host of new launches in existing categories.

The Company continued to make investments during the year towards enhancing brand salience and consumer connect while simultaneously focusing on implementing strategic cost management measures across the value chain and adopting a judicious pricing approach. Several initiatives were also implemented during the year towards leveraging the rapidly growing e-commerce channel for enhanced reach of the Company's products and harnessing digital and social media platforms for deeper consumer engagement.

In 2015-16, 3 Company-owned units (including 1 through a joint venture company viz., North East Nutrients Private Limited) were commissioned to cater to the requirements of the Branded Packaged Foods Businesses.

The FMCG Businesses comprising Branded Packaged Foods, Personal Care Products, Education and Stationery Products, Lifestyle Retailing, Incense Sticks (Agarbattis) and Safety Matches have grown at an impressive pace over the past several years.

The Company's vibrant portfolio of brands viz., 'Aashirvaad', 'Sunfeast Dark Fantasy', 'Sunfeast Yumfills', 'Sunfeast Delishus', 'Sunfeast Mom's Magic', 'Sunfeast Bounce', 'Bingo! Tedhe Medhe', 'Bingo! Mad Angles', 'Yumitos', 'YiPPee!', 'Candyman', 'mint-o', 'GumOn', 'Kitchens of India', 'Aashirvaad Svasti' in the Branded Packaged Foods space; 'Classmate' and 'Paperkraft' in Education & Stationery products market; 'Essenza Di Wills', 'Fiama Di Wills', 'Vivel', 'Superia' and 'Engage' in the Personal Care products segment; 'Wills Lifestyle' and 'John Players' in the Lifestyle Retailing Business; 'Mangaldeep' in Agarbattis, 'Aim' in Matches, amongst others continue to garner consumer franchise and enhance market standing. These brands, which represent an annual consumer spend of over Rs. 12000 crores in aggregate, have been built organically by the Company over a relatively short period of time - a feat unparalleled in the Indian FMCG industry. In terms of annual consumer spend, Aashirvaad and Sunfeast are today over Rs. 3000 crores and Rs. 2500 crores respectively while Classmate and Bingo! are over Rs. 1000 crores each. These world-class Indian brands support the competitiveness of domestic value chains of which they are a part, ensuring creation and retention of value within the country.

Q9. Please provide a revenue split of the FMCG-Others Segment.

Answer: The Branded Packaged Foods Businesses represent the largest component of this segment, accounting for ~73% of Segment Revenue. The Education and Stationery Business and Personal Care Business account for ~8% each of Segment Revenues.

Q10. What are the medium to long-term prospects of the FMCG industry in India? What are the new FMCG categories that the Company is likely to enter going forward?

Answer: While it is anticipated that the FMCG industry will take a few more quarters for demand revival, the green shoots of economic recovery, expectations of normal monsoons, low inflation, implementation of the 7th Pay Commission recommendations and the 'One Rank One Pension' scheme augur well for the industry. The structural drivers of long-term growth such as increasing affluence and consumer awareness, a young and expanding workforce and increasing urbanisation amongst others, remain firmly in place and the FMCG industry is poised for rapid growth in the ensuing years.

With aspirations to become the No.1 FMCG player in India, the Company continuously evaluates opportunities to grow in the FMCG space. The choice of category is guided by its growth prospects, profitability profile and the ability of the Company to effectively leverage its institutional strengths with a view to achieving leadership status within a reasonable time frame. Synergies with existing categories in terms of overlap of distribution reach, brand extension possibility, procurement efficiencies etc. are also considered while choosing new categories.

Chocolates, Dairy, Tea and Coffee are some of the interest areas in this context.

Q11. What is the margin profile of the Branded Packaged Foods Business?

Answer: The Branded Packaged Foods Businesses of the Company comprise 'Confections', 'Staples, Snacks and Meals' and 'Dairy & Beverages'. These Businesses have evolved over a period of time and are currently at different stages of their lifecycles. As such, the revenue dimensions, cost structures and profitability profiles of each of these businesses are distinct from the other. For example, EBIT margin is in the high single digit range for the Staples business (first full year of launch: 2002/03) while the same is in the low single digit range for the Snack Foods business (first full year of launch: 2007/08) representing upfront investments towards category development and brand building.

Overall, the mandate for each category is to achieve best-in-class margins within a reasonable period of time.

Q12. What is the margin profile of the Personal Care Products Business? When will it break-even?

Answer: The Personal Care Products Business presently comprises the 'Personal Wash', 'Deodorising Products', 'Skin Care' and 'Health and Hygiene' categories. The Company continues to make significant investments in this Business primarily in the area of brand building, R&D and product development towards competing effectively with incumbent players comprising firmly entrenched MNCs and domestic companies.

Presently, each category is operating at industry benchmarked gross margins. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins progressively over the medium-term.

Q13. What are the Company's targets in the FMCG-Others space? What does the Company envision in terms of revenue and profits in this segment, over the medium and long-term?

Answer: ITC's endeavour is to become the No.1 FMCG player in India driven by the existing portfolio as well as entry into new categories. In this regard, the Company is aiming for a revenue of Rs. 100,000 crores from the new FMCG businesses by the year 2030.

Over the medium term, the Company seeks to grow revenues of each category within the FMCG-Others segment at a rate which is well ahead of industry. With enhanced scale and consumer connect, each category is expected to earn best-in-class EBIT margins, progressively over the medium-term.

Q14. Would ITC contemplate acquisitions in order to achieve its vision in the Other FMCG segment?

Answer: ITC examines prospects for inorganic growth that arise from time to time not only in this business segment but also in the other businesses. The Company continues to evaluate opportunities to grow its businesses through Acquisitions and Joint Ventures and is guided by considerations such as strategic fit, valuation, financial viability, ease of integration etc.

In February 2015, the Company acquired the 'Savlon' and 'Shower to Shower' trademarks and other intellectual property rights for identified markets from the Johnson & Johnson group. Savlon is an established brand with a rich heritage and is associated with personal care products in the fast-growing antiseptic/anti-bacterial categories. Shower to Shower has a strong consumer franchise in the prickly heat talcum powder category. The Company intends to leverage these assets to strengthen its position in the personal care space by expanding its existing product portfolio and gaining access to newer consumer segments and markets.

The Company's recently acquired 'B Natural' brand was leveraged to foray into the fast growing Juices category. B Natural range of juices, currently available in 9 exciting variants, has garnered impressive consumer traction in a relatively short span of time and is well poised for rapid growth.

Q15. Please provide an update on the Company's progress in the FMCG-Others Segment during the quarter.

Answer: Segment Revenue recorded a growth of 3.4% during the quarter against the backdrop of subdued demand conditions exacerbated by the impact of cash crunch. Segment Results were adversely impacted by temporary disruption in sales momentum; sharp increase in cost of inputs such as wheat, maida, sugar, cashew, soap noodles; early 'end of season sales' and discounting in the Lifestyle Retailing Business and sustained investment in brand building activities. Segment Results also include the gestation cost relating to new categories viz. Juices, Chocolates, Dairy and Health & Hygiene segment in the Personal Care Products Business.

The Branded Packaged Foods Businesses posted steady growth in revenue despite the challenging operating environment with most major categories recording improvement in market standing.

In the Staples, Snacks and Meals Business, 'Aashirvaad' atta recorded healthy growth and consolidated its leadership position across markets. The 'Bingo!' range of snack foods continued to grow well, driven by the 'Tedhe Medhe' variant and 'Bingo! Yumitos Original Style' potato chips.

In the Confections Business, the 'Sunfeast Mom's Magic' range of premium cookies sustained its robust growth momentum driven by superior product attributes and continuing investment in brand building. Portfolio premiumisation continued in the Confectionery category driven by a higher salience of 'Re.1 and above' products in the sales mix. The recently launched 'Candyman Jellicious Jelimals' variant has been well received by consumers and is now available nationally. During the quarter, the Business launched an innovative variant in the Jellies segment under the sub-brand 'Candyman Jellicious DubbleZ'. The product is available in select markets and has received encouraging consumer response.

The Business expanded the footprint of 'Fabelle Chocolate Boutiques' to ITC Grand Central & ITC Maratha in Mumbai and ITC Windsor in Bengaluru during the quarter. With this, Fabelle Chocolate boutiques are now operational at 7 luxury ITC Hotels. During the quarter, the Business launched a range of 'Fabelle' gift hampers comprising a special collection of delectable chocolates. The range received excellent response from consumers during the festive season.

In November 2016, the Business commissioned a state-of-the-art facility at Uluberia, West Bengal for in-house manufacturing of atta, potato chips and biscuits. This facility will enable servicing of proximal markets in an efficient manner by enhancing product freshness and improving supply chain responsiveness. The Business continued to leverage the recently established biscuits manufacturing facility at Mangaldoi, Assam (set up by North East Nutrients Private Ltd. - a joint venture company) to enhance its market standing significantly in the fast growing north-eastern market.

The Personal Care Products Business continued to focus on augmenting its product portfolio and enriching product mix. Recently launched variants in the Hand Wash and Antiseptic Liquid categories under the Savlon brand continue to gain traction amongst consumers.

The Company made steady progress during the quarter towards setting up state-of-the-art integrated consumer goods manufacturing facilities at Panchla (West Bengal), Kapurthala (Punjab) and Ambarnath (Maharashtra). Currently, over 20 projects are underway and in various stages of development - from land acquisition/site development to construction of buildings and other infrastructure.

Please refer to the FMCG - Others section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2016 and Media Releases on quarterly results for further details.

Q16. Please provide an update on the Cigarettes business.

Answer: The performance of the Cigarette Business during the quarter was subdued on account of tight liquidity conditions prevailing in the market and continued regulatory and taxation pressures on the legal Cigarette industry in India.

Over the last 4 years, the incidence of Excise Duty and VAT on cigarettes, at a per unit level, has gone up cumulatively by 118% and 145% respectively thereby exerting severe pressure on legal industry volumes even as illegal trade grows unabated. It is pertinent to note that steep increases in Excise Duty on cigarettes in recent years have resulted in widening the differential in Excise Duty rates (on a per kg. of tobacco basis) between cigarettes and other tobacco products from 29 times in 2005/06 to over 53 times currently. High incidence of taxation and a discriminatory regulatory regime on cigarettes in India have over the years led to a significant shift in tobacco consumption to lightly taxed or tax-evaded tobacco products like bidi, khaini, chewing tobacco, gutkha and illegal cigarettes which presently constitute over 89% of total tobacco consumption in the country. Besides adversely impacting the performance of the legal cigarette industry, this has led to sub-optimisation of the revenue potential from the tobacco sector.

The operating environment for the legal Cigarette industry in India was rendered even more challenging in the wake of a further increase of 10% in Excise Duty announced in the Union Budget 2016 and introduction of the new 85% graphic health warnings (GHW) on cigarette packages.

On 4th May 2016, the Honourable Supreme Court directed the Honourable High Court of Karnataka to hear and dispose of within six weeks, the legal challenge to GHW pending in several High Courts. The Honourable Supreme Court, however, also ordered that any stay order granted by any High Court would not be given effect to till the cases are finally disposed of. The Company is currently manufacturing cigarettes with 85% warning in compliance with the interim requirements pending final decision by the Honourable Karnataka High Court on the matter. Hearings on the matter are currently underway.

The proposed GHW is excessively large, extremely gruesome and unreasonable. There is no evidence to suggest that cigarette smoking would cause the diseases depicted in the pictures or that large GHW will lead to reduction in consumption. It is pertinent to note that the global average size for GHW is only about 30% coverage of the principal display area. Moreover, the top three cigarette consuming countries - USA, China and Japan - which together account for 51% of global cigarette consumption have only text based warnings and have not adopted pictorial / graphic health warnings.

According to an independent study, India is now the 4th largest market for illegal cigarettes in the world. In fact, illegal trade comprising smuggled foreign and domestically manufactured tax-evaded cigarettes is estimated to constitute one-fifth of the overall cigarette industry in India and is estimated to cost the exchequer a revenue loss of more than Rs. 9000 crores per annum. The new GHW will encourage the flow of illegal trade of brands owned by international companies into the country since such brands are manufactured in many jurisdictions which do not mandate the printing of graphic health warnings on cigarette packages as applicable in India. The legal cigarette industry in India will be hard pressed to counter the menace of illegal cigarettes as they will be perceived by the consumer to be safer in the absence of the statutorily mandated health warnings. Coupled with the fact that illegal cigarettes are available at a fraction of the price of legal cigarettes, the new GHW will provide further fillip to the growth of illegal cigarettes in the country.

It may be noted that the Department of Commerce, in its submissions to the Parliamentary Committee on Subordinate Legislation, has stated that "large warnings will lead to an increase in overall tobacco consumption and illegal cigarettes; when large quantities of non-cigarette tobacco products from unorganised sector are sold loose and/or without any health warnings, it gives an impression of these products being relatively safer than cigarettes."

As always, the Company complies fully with all laws and regulations and continues to engage with policy-makers for reasonable, pragmatic and evidence based regulation and taxation policies that balance the health, employment and economic imperatives of the country.

Amidst the challenging operating environment as aforestated, the Company consolidated its market leadership through relentless focus on delivering world-class products, continuous innovation & value addition and best-in-class execution.

Please refer to the FMCG - Cigarettes section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2016 and Media Releases on quarterly results for further details.

Q17. What is the impact of increase in excise duty and VAT on cigarette volumes?

Answer: See response to Q. 16.

Q18. Is the pressure on volumes similar across the different segments i.e. King Size filters, Longs, Regular filters and filter cigarettes of 'length not exceeding 65 mm'?

Answer: While all segments are witnessing pressure on volumes, the Regular Filter segment has been the worst affected.

Q19. What is the Company's view on cigarette volume trends over the medium to long term?

Answer: As aforestated, legal cigarette industry volumes are currently facing severe pressure due to the steep increase in Excise Duty and VAT and the unabated rise in illegal trade.

As highlighted earlier, the share of legal cigarettes in overall tobacco consumption is 11% in India. While this indicates room for growth in legal cigarette volumes going forward, this would largely depend on the taxation and regulatory policy on cigarettes adopted by the Government. Such growth potential was demonstrated during the period 2004/05 to 2006/07 and again, more recently, in 2009/10 and 2011/12 - years in which taxes / duties growth was moderate.

A stable, fair and equitable India-centric cigarette taxation and regulatory policy which recognises the unique tobacco consumption pattern in the country is critical to realising the full economic potential of the tobacco sector in India.

The Company continues to engage with the concerned authorities, both at the Central Government and State level, in this regard.

Q20. What would be the likely impact of the larger graphic health warnings (GHW) on packs on the cigarette industry?

Answer: The proposed GHW is excessively large, extremely gruesome and unreasonable. There is no evidence to suggest that cigarette smoking would cause the diseases depicted in the pictures or that large GHW will lead to reduction in consumption. In fact this inadequacy of evidence prompted the courts in USA to hold the US FDA's proposal for introduction of similar GHW in that country as unconstitutional. Further, over 100 countries representing 60% of the signatories to the Framework Convention on Tobacco Control have not adopted GHW1. It is pertinent to note that other major tobacco producing countries have taken a considered view on the matter and have not adopted over-sized and excessive graphic health warnings, thus striking a balance between the interests of the consumer and of their farmers. It may also be noted that the global average size for GHW is only about 30% coverage of the principal display area. Moreover, the top three cigarette consuming countries - USA, China and Japan - which together account for 51% of global cigarette consumption have only text based warnings and have not adopted pictorial / graphic health warnings.

The new GHW will commoditise the market where price will be the sole or prime driver of consumer choice thus eroding the value of the Company's distinctive trademarks and pack designs that have been developed and nurtured through substantial investments over the years. Moreover, the new GHW will encourage the flow of illegal trade of brands owned by international companies into the country since such brands are manufactured in many jurisdictions which do not mandate the printing of graphic health warnings on cigarette packs as applicable in India. The legal cigarette industry in India will be hard pressed to counter the menace of illegal cigarettes which will be perceived by the consumer to be safer in the absence of the statutorily mandated health warnings. Coupled with the fact that illegal cigarettes - which evade taxes / duties - are available at a fraction of the price of legal cigarettes, the new GHW will provide further fillip to the growth of illegal cigarettes in the country.

It is pertinent to note that the Department of Commerce, Government of India, in its submissions to PCOSL, has stated that "large warnings will lead to an increase in overall tobacco consumption and illegal cigarettes; when large quantities of non-cigarette tobacco products from unorganised sector are sold loose and / or without any health warnings, it gives an impression of these products being relatively safer than cigarettes."

As always, the Company complies fully with all laws & regulations and continues to engage with policy-makers for reasonable, pragmatic and evidence based regulation and taxation policies that balance the health, employment and economic imperatives of the country.

1 Canadian Cancer Society - Cigarette Package Health Warnings, International Status Report, Fourth Edition, September 2014

Q21. What are the Company's plans in the 'other tobacco and nicotine products' space?

Answer: In the Nicotine Gum category, the presence of the Company's brand, 'Kwiknic', was expanded with the introduction of the product in the chemists channel during 2015-16. The Business also launched a new variant - 'Kwiknic Neo' - in select markets which has received encouraging response from consumers.

Electronic Vaping Devices (EVD) are gaining increasing traction with consumers seeking alternative sources of nicotine. In line with this trend, the Company continues to engage in this category through its brand 'EON'. A rechargeable variant - 'EON Charge', introduced last year is being extended across target markets.

Q22. Please provide an update on the Company's Hotels business.

Answer: The hospitality sector continued to be adversely impacted by a weak pricing scenario in the backdrop of excessive room inventory in key domestic markets and sluggish macroeconomic environment both in India and major source markets. Despite a challenging operating environment, the Business recorded a healthy growth in Segment Revenue and Profit during the quarter driven by improvement in Average Room Rate and robust growth in the Food & Beverage revenue.

While Segment Results improved significantly as compared to the corresponding quarter in the previous year, profitability remained relatively muted due to the challenging business context as aforestated and gestation costs of the recently commissioned ITC Grand Bharat, Gurgaon.

In yet another international recognition in its debut year, the ITC Grand Bharat, Gurgaon was ranked No. 4 among the 'Top 100 Hotels & Resorts of the World' and No.1 among the 'Top 25 Resorts in Asia' on the coveted Conde Nast Traveller U.S. Readers' Choice Awards. The luxury retreat is the only hotel from India to feature in the 'Top 50 of the world's best'. The hotel also received the Outlook Traveller Award for the 'Indian Hotel Debut of the year'. ITC Maurya was adjudged the 'Best Business Hotel' in India at the Lonely Planet Awards. ITC Hotels Business was recognised as the 'Most Respected Company' in the hospitality segment in a survey conducted by Business World. ITC Hotels was also adjudged the 'Best Hotel Group' at Travel + Leisure, India & South Asia Awards 2015.

The Company's Hotels Business continues to be rated amongst the fastest growing hospitality chains in India, with over 100 properties across the country under 4 distinct brands -'ITC Hotels' in the Luxury segment, 'WelcomHotel' in the upper-upscale segment, 'Fortune Hotels' in the upscale & mid-market space and 'WelcomHeritage' in the leisure & heritage segment. In 2015-16, the Business renewed its licensing and franchising agreements with Starwood Hotels & Resorts for 'The Luxury Collection' and 'Sheraton' brands. Apart from the 12 existing properties under the ITC group, the association as aforestated will be extended to another 3 hotels that are under construction.

In line with the Company's commitment to the 'Triple Bottom Line', the Hotels Business strives continuously to reduce water and energy consumption and enhance the usage of renewable energy sources. Nearly 60% of the total energy requirements of the Business is presently met through renewable energy sources. During the year, the Business extended several 'Responsible Luxury' themed culinary initiatives and promotions under the 'Kitchens of India' banner. These interventions stand testimony to the 'Responsible Luxury' positioning of the Company's Hotels Business and reinforce ITC Hotels' position as the 'greenest luxury hotel chain' in the world.

Please refer to the Hotels section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2016 and Media Releases on quarterly results for further details.

Q23. Please provide an update on the Company's Agri Business.

Answer: Segment Revenue grew by 12.9% driven by trading opportunities in the domestic wheat market, external sales of leaf tobacco offset by lower supplies to the Company's FMCG businesses (mainly account timing differences in offtake).

The Business provides strategic sourcing support to the Company's Cigarette business and leverages its deep rural linkages to source superior quality wheat, chip stock potato, spices and fruit pulp at competitive prices for the Branded Packaged Foods Businesses. The Business continues to leverage the e-choupal network to source superior quality wheat at competitive cost and deliver substantial savings to the system through efficient logistics management and other cost-optimisation initiatives.

The Business is collaborating with research organisations such as Indian Agricultural Research Institute, Directorate of Wheat Research, Punjab Agricultural University and Agarkhar Research Institute towards scaling up wheat sourcing from areas that are in close proximity of atta manufacturing plants. As part of its wheat crop development program, the Business has introduced location-specific new and improved seed varieties along with appropriate package of practices across many States and continues to focus on augmenting capabilities in proprietary crop intelligence, scaling up the sourcing & delivery network and developing blends based on consumer requirements.

Please refer to the Agri Business section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2016 and Media Releases on quarterly results for further details.

Q24. Please provide an update on the Company's Paperboards, Paper and Packaging Segment.

Answer: The performance of Paperboards, Paper & Packaging Segment continued to be impacted by sluggish demand conditions prevailing in the FMCG and legal Cigarette industry. Zero duty imports under ASEAN Free Trade Agreement, cheap imports from China along with capacity ramp up by other industry players adversely impacted Segment Revenue during the quarter. Segment Results, however, improved on the back of benign input costs and improved mix.

Despite heightened competitive intensity, the Company sustained its leadership position in the Value Added Paperboard (VAP) segment through effective key account management, focus on product & process innovation, enhanced service delivery levels leveraging strategically located 'quick service centres' and improved manufacturing efficiencies.

In an endeavour to reduce its dependence on imported pulp, the Business is in the process of setting up India's first Bleached Chemical Thermo Mechanical Pulp mill at its Bhadrachalam unit. The facility is expected to be commissioned shortly. Capacity expansion in the Value Added Paperboards and Décor segments is also underway.

The Packaging and Printing Business continued to sustain its leadership position in domestic packaging and printing industry. The Company's world-class facility at Haridwar is operating at benchmark standards and has strengthened the Business' ability to service demand in the northern markets more effectively. The Business stabilised the recently commissioned in-house cylinder manufacturing plant at the Haridwar unit and blown film manufacturing capability at the Tiruvottiyur unit. These investments have augmented the capabilities of the Business and are facilitating speedier fulfilment of customer orders thereby enhancing its competitive position.

Please refer to the Paperboards, Paper & Packaging section in the Report of the Directors & Management Discussion and Analysis for the financial year ended 31st March 2016 and Media Releases on quarterly results for further details.

Q25. Please provide an overview of the capex plan of the Company.

Answer: The Company's capex plans are directed primarily towards capacity gearing, productivity enhancement, ensuring the highest standards in quality and environment, health & safety, and R&D.

One of the key elements of the capex plan going forward is to invest in setting up state-of-the-art owned integrated consumer goods manufacturing and logistics facilities across regions in line with long-term demand forecasts. Currently, over 20 projects are underway and in various stages of development - from land acquisition/site development to construction of buildings and other infrastructure.

In the Hotels Business, the Company is progressing the construction of new hotels in Kolkata, Hyderabad, Ahmedabad and Coimbatore. Besides, WelcomHotels Lanka Private Ltd. - a wholly-owned subsidiary of the Company - is developing a mixed-use project including a luxury hotel and a premium condominium in Colombo, Sri Lanka.

The major items of capital expenditure in the Paperboards, Paper and Packaging segment going forward comprise paperboards & specialty paper capacity augmentation/machine rebuild at the Bhadrachalam and Tribeni units, investments in setting up a state-of-the-art Bleached Chemical Thermo-Mechanical pulp line at the Bhadrachalam unit, capacity augmentation in Cartons and Flexibles packaging at the Tiruvottiyur unit.

Overall, the Company estimates capex of approx. Rs. 20000 crores over the next 5 years. However, this would depend on several factors such as a pick-up in economic activity and improvement in demand conditions, timely acquisition of land at appropriate locations, obtaining approvals from the concerned authorities in a timely manner etc.

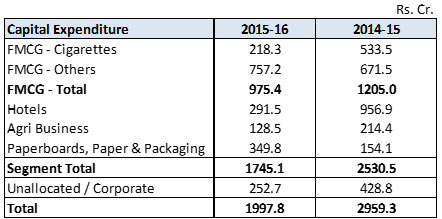

Q26. Please provide details of the Company's Capital expenditure by Business.

Answer: The Company's Capex during the last two financial years is tabulated below:

Q27. Why has the Segment Assets increased by Rs. 1135 crores from Rs. 27367 crores as at 31st December 2015 to Rs. 28502 crores as at 31st December 2016?

Answer: The increase in Segment Assets was primarily on account of

- higher Net Fixed Assets (net of depreciation) towards capacity augmentation in FMCG businesses, ongoing investments in Hotels and capacity augmentation & cost reduction related investments in Paperboards, Paper and Packaging business.

Q28. Why has the Segment Liabilities increased by Rs. 518 crores from Rs. 5965 crores as at 31st December 2015 to Rs. 6483 crores as at 31st December 2016?

Answer: The increase in Segment liabilities was primarily on account of higher trade payables (in line with business growth) and higher capex payables.

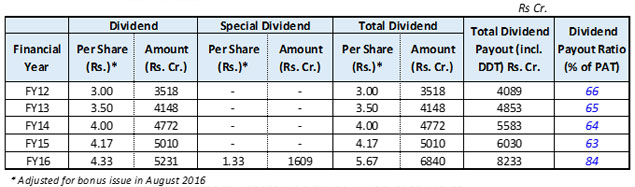

Q29. What are the dividend payout trends in recent years?

Answer: Dividend paid out by the Company for the last 5 years is given below:

Please refer to the following link for the Dividend Distribution policy of the Company.

http://www.itcportal.com/about-itc/policies/dividend-distribution-policy.pdf

Q30. Please explain the Company's 'Triple Bottom Line' philosophy.

Answer: The Company's vision to sub-serve larger national priorities and create enduring societal value is the inspiration for its multi-dimensional sustainability initiatives that are today acknowledged as global exemplars. The Company's sustainability strategy aims to significantly enhance value creation for the nation through superior 'Triple Bottom Line' performance that builds and enriches the country's economic, environmental and societal capital. It is premised on the belief that the transformational capacity of business can be effectively leveraged to create significant societal value through a spirit of innovation and enterprise.

The Company's models of sustainable development and value chains designed to promote livelihoods have supported the creation of around 6 million sustainable livelihoods, largely among the marginalised sections of society. The Company has sustained its position of being the only Company in the world of comparable dimensions to have achieved the global environmental distinction of being water positive (for 14 consecutive years), carbon positive (for 11 years in a row) and solid waste recycling positive (for 9 years in succession).

The Company's renewable energy portfolio ensures that over 47% of its total energy requirements are met from renewable energy sources - a remarkable achievement given the large manufacturing base of the Company. Further, premium luxury hotels, several office complexes and factories of the Company are LEED® (Leadership in Energy & Environmental Design) certified at the highest level by the US Green Building Council/Indian Green Building Council and the Bureau of Energy Efficiency (BEE) under its star rating scheme.

The Company's 13th Sustainability Report, published during the year detailed the progress made across all dimensions of the 'Triple Bottom Line' for the year 2015-16. The Company's Sustainability Report in conformance with the new Global Reporting Initiative (GRI) G4 Guidelines has been third party assured. The report has achieved the highest "In Accordance - Comprehensive" level of reporting prescribed under the G4 Guidelines of the Global Reporting Initiative.

In addition, the Business Responsibility Report (BRR) of the Company, as mandated by the Securities & Exchange Board of India (SEBI), which forms part of the Report and Accounts 2016, maps the sustainability performance of the Company against the reporting framework indicated by SEBI.

Q31. Please provide an update of the Company's Corporate Social Responsibility Programme.

Answer: The Company's Corporate Social Responsibility (CSR) programmes aim to address the challenges arising out of poverty, environmental degradation and climate change through a range of activities that inter alia include supporting rural development, promoting education, providing preventive healthcare, providing sanitation & drinking water, enhancing environmental & natural capital, preserving & promoting sports and creating livelihoods for people, especially those from disadvantaged sections of society.

The footprint of the Company's Social Investments Programme can be viewed at a glance in the following chart:

| Intervention Areas | Unit of Measurement | Cumulative till date |

|---|---|---|

| Social and Farm Forestry Soil and Moisture Conservation Programme |

Hectare Hectare |

249,671 286,241 |

| Sustainable Agricultural Practices Compost Units |

Number |

32,864 |

| Sustainable Livelihoods Initiative Cattle Development Centres Animal Husbandry Services |

Number Artificial Inseminations (in lakhs) |

223 19.47 |

| Economic Empowerment of Women Ultra Poor Women covered Self Help Group Members Livelihoods created |

Number Number Number |

12,750 29,851 53,616 |

| Primary Education Children covered |

Number (in lakhs) |

5.04 |

| Health and Sanitation Low Cost Sanitary Units Households covered under Solid Waste Management |

Number Number |

20,093 47,910 |

| Vocational Training Students Enrolled |

Number |

40,446 |